How TEVA’s CNS Drugs Performed in 1H17

In 1H17, Teva Pharmaceutical’s (TEVA) CNS (central nervous system) business generated revenues of ~$2.3 billion, or ~16% lower YoY (year-over-year).

Sept. 14 2017, Updated 9:07 a.m. ET

CNS drugs business trends

In 1H17, Teva Pharmaceutical Industries’ (TEVA) CNS (central nervous system) business generated revenues of ~$2.3 billion, or ~16% lower YoY (year-over-year). In 2Q17, TEVA’s CNS business generated revenues of ~$1.16 billion, or ~18% lower YoY and 2% higher QoQ (quarter-over-quarter) basis. Copaxone contributed ~$1.0 billion to TEVA’s total revenues in 2Q17.

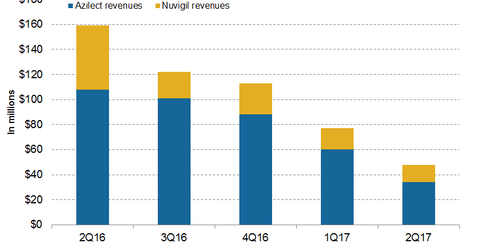

Azilect revenue trends

In 1H17, Azilect reported revenues of ~$94 million, or ~54% lower YoY. In 2Q17, Azilect generated revenues of ~$34 million, or ~69% lower YoY and 43% lower QoQ. Rising competition with the generic versions of Azilect in US and European markets caused this decline.

Teva’s exclusivity protection of Azilect in the EU expired in 2015, and generic versions of Azilect started entering the US in 2017. In June 2017, Teva applied for the approval of Azilect in Japan. Teva and Takeda Pharmaceuticals agreed to grant Takeda marketing rights of Azilect in Japan.

Azilect (rasagiline) is used for the treatment of individuals with Parkinson’s Disease (or PD). Teva’s peers in the PD drug market include Merck (MRK), AbbVie, Allergan, Impax Laboratories, and Pfizer.

Nuvigil revenue trends

In 1H17, Nuvigil reported revenues of around $31 million, or ~80% lower YoY. In 2Q17, Nuvigil generated revenues of ~$14 million, or ~73% lower YoY and ~18% lower QoQ.

Nuvigil (armodafinil) is used to improve wakefulness in adult individuals with excessive sleepiness associated with OSA (obstructive sleep apnea), narcolepsy, or SWD (shift work disorder). Teva’s peers in the narcolepsy drug market include Jazz Pharmaceuticals (JAZZ) and Novartis (NVS).

In June 2017, Teva announced that phase-3 studies of fremanezumab for the treatment of individuals with chronic migraines and episodic migraines met all the primary and secondary endpoints of the trial. Teva expects to submit biologics license applications to the FDA (US Food and Drug Administration) by the end of 2017.

Notably, the PowerShares International Dividend Achievers Portfolio (PID) invests ~1.0% of its total portfolio in TEVA.