Why France’s Services PMI Fell in August

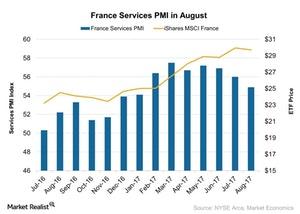

According to data provided by Markit Economics, the August France Services PMI (purchasing managers’ index) stood at 54.9 in August 2017 compared with 56 in July 2017.

Sept. 21 2017, Updated 10:06 a.m. ET

France’s services PMI in August 2017

According to data provided by Markit Economics, the August France services PMI (purchasing managers’ index) stood at 54.9 in August 2017 compared with 56 in July 2017. The figure didn’t meet the initial estimate of 55.5.

France’s services PMI has been weakening since June 2017. The August services PMI was the lowest reading since January 2017. France’s August services PMI was affected by the following factors:

- Production volume and output slowed.

- New business orders and export orders showed slower improvement.

- Employment also increased at a softer rate in August 2017.

However, France’s manufacturing PMI showed a stronger expansion in August 2017. Improvement in domestic demand in the manufacturing sector was the primary driver of manufacturing PMI in that month.

Rising costs mainly hampered France’s (EWQ) service sector performance in August 2017. Domestic consumption in the service sector fell marginally. However, service firms are still optimistic about the demand outlook of the economy.

Performance of various ETFs in August

The iShares MSCI France ETF (EWQ), which tracks France’s performance, rose 0.8% in August 2017. The iShares MSCI Eurozone ETF (EZU), which tracks the performance of the Eurozone (HEDJ) (FEZ) (IEV), rose 0.5% during the month.

In the next part of this series, we’ll analyze the final services PMI for Germany in August 2017.