Kansas City Southern: Behind the Freight Volume Rise in Week 33

Kansas City Southern hauled ~26,000 railcars in the same week compared with close to 25,000 units in the week ended August 20, 2016.

Aug. 29 2017, Updated 9:07 a.m. ET

KSU’s railcars in week 33

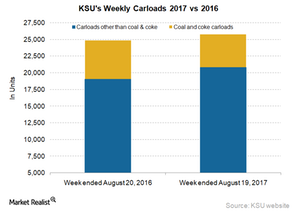

Missouri-based Kansas City Southern (KSU) is the smallest Class I railroad in the US. KSU’s total railcar volumes rose 3.7% in the week ended August 19, 2017. Kansas City Southern hauled ~26,000 railcars in the same week compared with close to 25,000 units in the week ended August 20, 2016.

KSU’s other-than-coal-and-coke volumes jumped 9.4% in the 33rd week of 2017. It hauled ~21,000 railcars, excluding coal (ARLP) and coke, in the same week compared with 19,000 units last year.

The railcar growth for Kansas City Southern was halted by a decline in coal and coke volumes. The company’s coal and coke volumes declined 15% to ~5,000 carloads in the 33rd week of 2017 from 5,800 units in the comparable week last year.

In the past few weeks, the pace of KSU’s coke and coal carloads has fallen year-over-year. This metric was much better among KSU’s peer group in 1Q17. In the reported week, Kansas City Southern registered much higher railcar growth compared with its US peers.

KSU’s intermodal traffic in week 33

In the week ended August 19, 2017, Kansas City Southern witnessed 6.3% growth in its overall intermodal traffic. The company moved ~20,000 trailers and containers in the same week compared with ~19,000 units in the week ended August 20, 2016.

KSU’s container volumes rose 6.4% to ~20,000 units in week 33 of 2017. In the same week last year, this metric totaled 18,500 containers. Containers dominate KSU’s intermodal traffic mix, accounting for ~98% of the traffic. The rise in trailers reached ~1% to 260 units. In the reported week of 2017, the company’s intermodal growth was in line with the percentage volume gains reported by Mexican and US rail carriers.

The Guggenheim S&P 500 Equal Weight ETF (RSP) includes all US-originated Class I railroads (UNP) in its portfolio.

In the next article, we’ll provide an update on Canadian National Railway (CNI).