Could North Korea Be Affecting Precious Metal Prices?

North Korean tensions Like the US dollar, global tensions can be responsible for precious metal price fluctuations. North Korea has interpreted US president Donald Trump’s comments as a declaration of war, stating that Pyongyang has the right to take countermeasures, including shooting down US bombers outside of its airspace. The ongoing unrest in the Korean peninsula has led to a global […]

Sept. 29 2017, Updated 6:03 p.m. ET

North Korean tensions

Like the US dollar, global tensions can be responsible for precious metal price fluctuations. North Korea has interpreted US president Donald Trump’s comments as a declaration of war, stating that Pyongyang has the right to take countermeasures, including shooting down US bombers outside of its airspace.

The ongoing unrest in the Korean peninsula has led to a global fall in equities, as well as US bond yields. Market turmoil can boost haven bids for gold and silver.

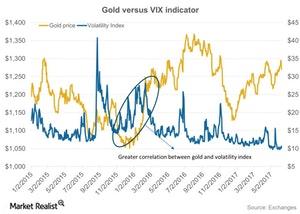

Volatility index

The above chart depicts how gold moves with market volatility, represented here by the VIX (VXZ) (VIXY). The VIX is a broad measure of market sentiment. With high volatility, equities tend to fall, and gold tends to rise.

Investors could expect precious metal prices to rebound if North Korean tensions worsen. Precious metals have been negative over the past two weeks due to the Fed’s hawkish tone and the subsequent dollar gains.

The ETFS Physical Swiss Gold Shares ETF and the ETFS Physical Silver Shares ETF (SIVR) have lost 1.1% and 2.8%, respectively, over the last week. Harmony Gold (HMY), Franco-Nevada (FNV), Agnico Eagle Mines (AEM), and Sibanye Gold (SBGL) have also fallen, by 3.7%, 1.5%, 3.4%, and 6.2%, respectively.