Inside China’s Steel Demand Indicators and Outlook for Iron Ore

To gauge the steel demand outlook in China, it’s important to keep an eye on the property sector.

Sept. 11 2017, Updated 9:06 a.m. ET

China’s property sector

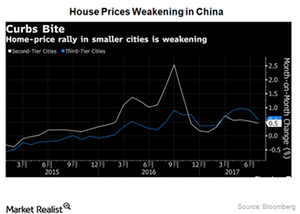

To gauge the steel demand outlook in China, it’s important to keep an eye on the property sector. This sector is critical to seaborne iron ore demand.

China’s property sector appeared to be under pressure in July. Home prices rose in fewer cities in July as compared to June. The investment in fixed assets also grew by 8.3% in the January-July period, compared with 8.6% in the January-June period. This was also below economists’ forecasts, which expected the growth pace to remain steady. New construction starts have also been contracted for the first time since September 2016.

China’s auto sales

While the latest set of data for the property sector in China remained weak, the auto sales data depicted a different trend. While auto sales had fallen for the previous two months, the data details for July were positive, showing ~2.0 million unit sales. This data implied a growth of 6.2% YoY (year-over-year), while vehicle sales grew by 4.1% YoY in the first seven months of 2017, compared with the same period last year.

This increase was, however, lower than last year’s growth, mainly due to the roll back in part of the tax incentive started by the Chinese government in 2016. CAAM (China Association of Automobile Manufacturers) is forecasting a growth rate of 5% in the auto sector in 2017.

A slowdown in growth in auto sales is negative for global steel (SLX) demand, and lower steel demand is negative for iron ore demand, which impacts seaborne iron ore players like Vale (VALE), Rio Tinto (RIO), and BHP Billiton (BHP) as well as Cleveland-Cliffs (CLF).