Chemours: Analysts’ Recommendations and More

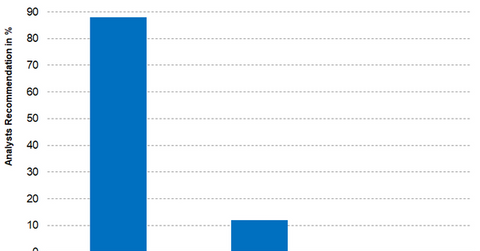

For Chemours, 88% of the analysts recommended a “buy,” 12% of the analysts recommended a “hold,” and none of the analysts recommended a “sell.”

Sept. 13 2017, Updated 1:35 p.m. ET

Analysts’ recommendations

As of September 11, 2017, eight analysts are actively covering Chemours (CC) stock. Among the analysts, 88% recommended the stock as a “buy,” 12% recommended the stock as a “hold,” and none of the analysts recommended the stock as a “sell.”

Analysts’ consensus indicates that Chemours’ 12-month target price is $56.50, which implies a return potential of 11.90%—compared to the closing price on September 11, 2017.

Why analysts recommend a “buy”

Chemours posted better-than-expected earnings in 2Q17 and beat analysts’ expectations. Continued growth in the demand for titanium-dioxide and the price increase is expected to drive its Titanium Technologies segment. The demand for Chemours’ Opteon refrigerant is expected to remain strong due to the continued adoption of regulatory requirements in Europe and the US. Chemours revised its outlook and expects to post adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of ~$1.3 billion–$1.4 billion compared to previous guidance of $1.15 billion–$1.25 billion. All of these factors would have influenced most of the analysts to recommend a “buy” on the stock.

Individual recommendations by brokerage firms

- UBS (UBS) upgraded Chemours’ rating to “neutral” from “sell,” but didn’t provide a target price.

- Earlier, Barclays (BCS) rated Chemours as a “buy.” It raised the target price to $55, which implies a return potential of 8.90%—compared to the closing price on September 11, 2017.

- Jefferies recommended a target price of $60 for Chemours, which implies a return potential of 18.80% based on its closing price of $50.50 as of September 11, 2017.

- J.P. Morgan (JPM) sees Chemours’ stock price at $50. However, the stock has breached the recommended target price as of September 11, 2017.

Investors looking to invest indirectly in Chemours can invest in the PowerShares DWA Basic Materials Momentum Portfolio (PYZ). PYZ has invested 5.10% of its portfolio in Chemours as of September 11, 2017.

In the next part, we’ll discuss Chemours’ valuations compared to its peers.