BD Stock Fell 2.7% on September 13: Should Investors Worry?

Becton, Dickinson and Company (BDX) closed at $196.62 on September 13, 2017.

Sept. 15 2017, Updated 12:35 p.m. ET

BD stock performance

Becton, Dickinson and Company (BDX), or BD, closed at $196.62 on September 13, 2017. On the day, the stock fell around 2.7% from its opening price of $201.64 and traded at a higher than average volume of 1.2 million shares. Around 1.9 million shares were traded on September 13, 2017.

BD stock has a 50-day moving average of around $199.76 and a 200-day moving average of around $191.20. The stock has a beta of 1.02, which signifies a higher volatility than the market in the same direction as the market moves.

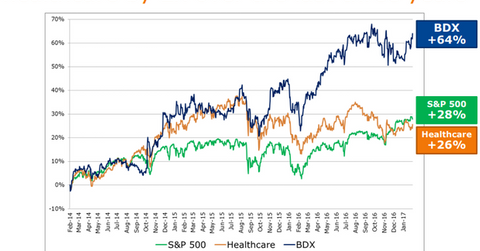

However, the stock has given steady returns over the long term and has outperformed the market, as shown in the diagram above. In the last one year, BD has returned around 15%. Its YTD (year-to-date) performance has also been strong with stock returns of around 19.3%. However, the stock has fallen. Over the last one month, the stock fell ~2.1%. Over the last week, the stock has seen a fall of more than 1%.

Investors who want exposure to BD can invest in the Vanguard Growth ETF (VUG), which has ~0.42% of its holdings in BD.

BD fundamentals

BD is a leading company in the medical technology space around the world. It has a market capitalization of $44.7 billion. The company has a strong product portfolio with a presence all over the globe. It is the leader in the medication management market where players like McKesson (MCK) and Cerner (CERN) pose strong competition. The company could further strengthen its market position and product portfolio with the acquisition of C.R. Bard (BCR), which is expected to be completed in the fall of 2017. For more on the acquisition progress, read Becton Dickinson’s Bard Acquisition: On Track, Gaining Momentum.

The company has been undergoing restructuring and reorganization along with the business model changes in its US dispensing business to transform to a leaner and more efficient organization with leadership across its core capabilities. BD has a strong product pipeline with key product launches expected in the second half of 2017 and beyond. The company continually makes strategic investments in research and development.

Continuous strategic partnerships and collaborations and balanced organic and inorganic growth strategies have positioned BD as a key growth company with bright prospects. However, in the near term, it is facing some temporary headwinds including the impact of US dispensing business model changes and respiratory business solutions divestments. Integration challenges might also impact the company once the C.R. Bard acquisition gets completed in the fall of 2017. Such short-term challenges might weigh down on the company’s operational growth in the near term, which, however, is expected to be robust in the years ahead.