McKesson Corp

Latest McKesson Corp News and Updates

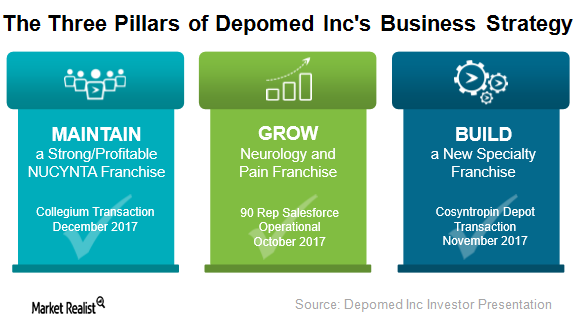

Behind Depomed’s Business Strategy

Depomed (DEPO) has adopted a three-pronged business strategy with three key elements: maintain, build, and grow.

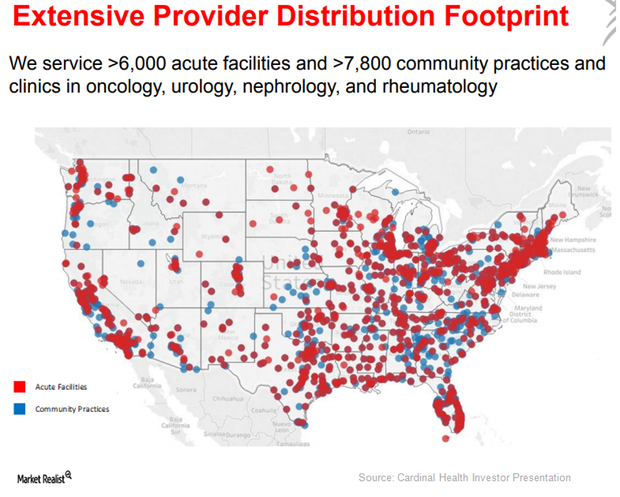

Robust Growth Expected for Cardinal Health’s Specialty Solutions

Cardinal Health’s (CAH) Specialty Solutions segment provides two types of services: upstream to pharmaceutical and biopharmaceutical manufacturers and downstream to healthcare providers.

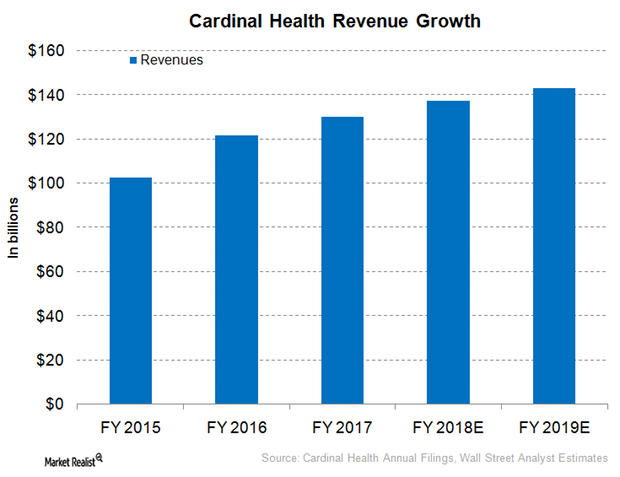

Cardinal Health Expected to Report Modest Revenue Growth

For fiscal 2018, Cardinal Health (CAH) has projected mid-single-digit revenue growth on a YoY basis, partially driven by the company’s high customer retention rates.

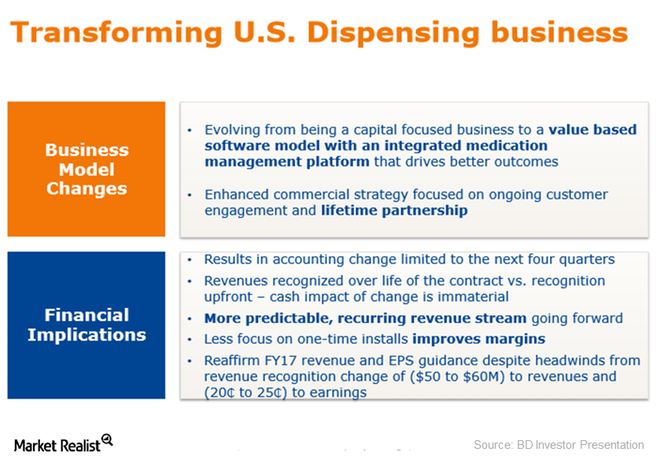

Headwind for Becton Dickinson: US Dispensing Business

Becton Dickinson (BDX) is the leading player in the US dispensing business. Its Pyxis system sales contribute significantly to the company’s total revenues.

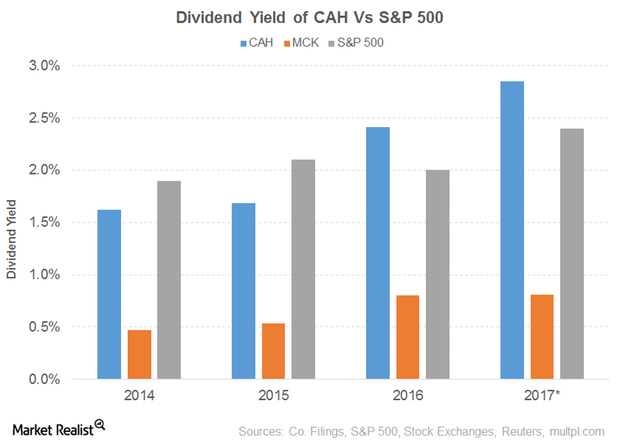

Dividend Yield of Cardinal Health

Cardinal Health’s (CAH) PE ratio of 16.0x compares to a sector average of 20.4x. The dividend yield of 2.9% compares to a sector average of 2.0%.

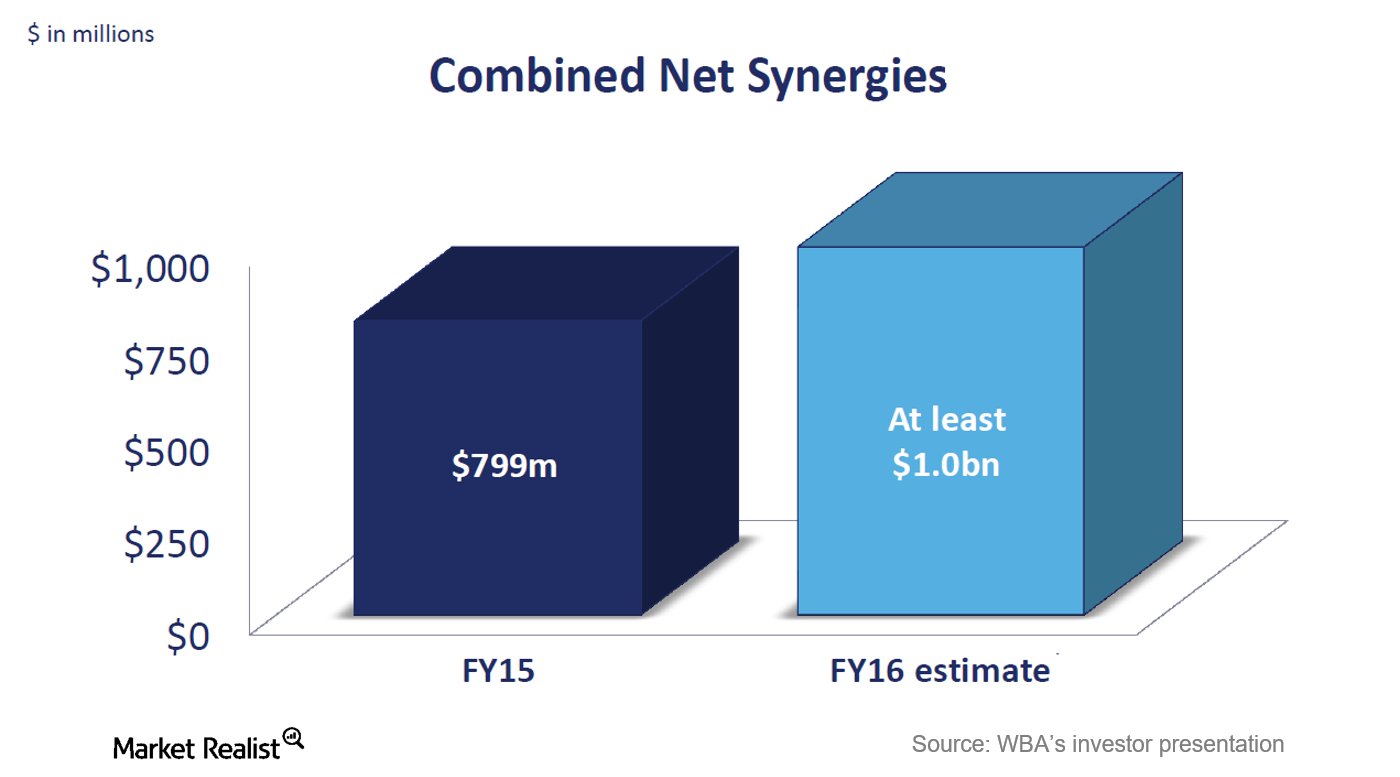

Walgreens Boots Alliance: Merger of Walgreens and Alliance Boots

Walgreens became a wholly owned subsidiary of Walgreens Boots Alliance after a merger.Healthcare Computer Programs and Systems, Inc.’s impressive management team

Computer Programs and Systems, Inc. (CPSI): Management team At CUSH, we hold a monthly investors club for area executives and other successful investors. One of the members got us excited about the idea after speaking very highly of the CPSI, sharing great insight. This, coupled with having recently read an article from Forbes[1. Forbes, “Land Shares […]