Analysts’ Recommendations and Price Target for SQM

Sociedad Química y Minera de Chile (SQM) has yet to announce its earnings, unlike most of the companies we’ve discussed so far in this series.

Nov. 20 2020, Updated 12:48 p.m. ET

SQM

Sociedad Química y Minera de Chile (SQM) has yet to announce its earnings, unlike most of the companies we’ve discussed so far in this series. The company produces iodine and potassium nitrate. Its potash products are used for fertilizer applications.

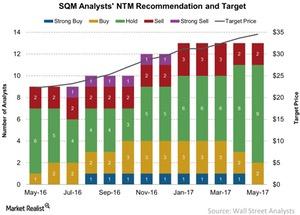

Let’s look at analysts’ recommendations and price targets for SQM over the next 12 months.

Recommendations

No analysts recommend “strong buys” on Sociedad Química y Minera de Chile for the next 12 months, in contrast to the recommendations for FMC Corporation (FMC), Monsanto (MON), and CF Industries (CF). Two analysts, however, have “buy” recommendations on the stock, nine have “hold” recommendations, and two have “sell” recommendations on the stock for the next 12 months.

Price target

On May 10, 2017, the consensus price target for Sociedad Química y Minera de Chile was $34.53 per share, 2.6% higher month-over-month compared to $33.7 per share. On May 10, the stock closed at $34.25 per share, just 80 basis points below analysts’ consensus price target for the stock in the next 12 months.

For more information on the agricultural fertilizer industry (NANR), be sure to visit Market Realist’s Agricultural Fertilizers page.