Sociedad Quimica Y Minera De Chile SA

Latest Sociedad Quimica Y Minera De Chile SA News and Updates

How to Play the EV Boom by Investing in Lithium

As EV adoption is expected to rise, everybody wants a share of the pie. Is investing in lithium a way to go? This guide will teach you how to invest in lithium stocks.

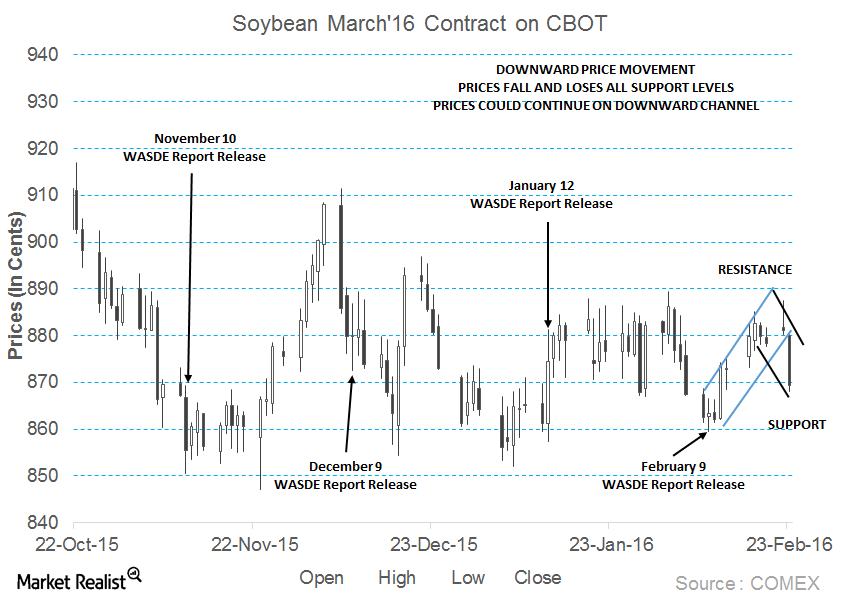

Soybean Prices Might Continue on the Downward Channel

March soybean futures contracts were trading near the support level of $8.70 per bushel on February 23. Prices fell for the second consecutive trading day.

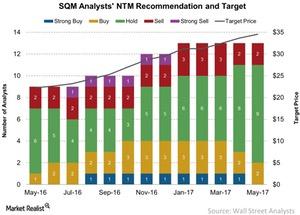

Analysts’ Recommendations and Price Target for SQM

Sociedad Química y Minera de Chile (SQM) has yet to announce its earnings, unlike most of the companies we’ve discussed so far in this series.

Reviewing Albemarle’s Stock Performance since 3Q17

Albemarle (ALB) is set to announce its 4Q17 results after the market closes on February 27, 2018.

Scotts Miracle-Gro: Ratings and Price Target for January

Nine Wall Street analysts are covering Scotts Miracle-Gro, They have a consensus mean rating of 2.3 on the stock with an overall “buy” recommendation as of January 10, 2018.

Agribusiness Stocks: Analyst Ratings, Price Targets in October

We’re nearing the end of the year, and most agribusiness stocks have underperformed the benchmark indexes.