An Update on Novartis’s Sandostatin, Afinitor, and Exjade

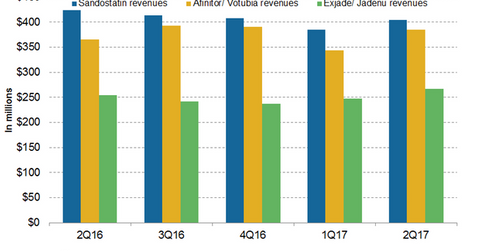

In 1H17, Novartis’s (NVS) Sandostatin generated revenues of around $789 million, which reflected a ~4% decline on a year-over-year (or YoY) basis.

Sept. 19 2017, Updated 10:38 a.m. ET

Sandostatin revenue trends

In 1H17, Novartis’s (NVS) Sandostatin generated revenues of around $789 million, which reflected a ~4% decline on a year-over-year (or YoY) basis. In 2Q17, Sandostatin generated revenues of around $404 million, which reflected a ~5% decline on a YoY basis and 5% growth on a quarter-over-quarter basis. The increasing generic competition was primarily to blame for the decline in the revenues in 2Q17 and 1H17.

Sandostatin (octreotide) is used to reduce the levels of the growth hormone and IGF-I (somatomedin C) in individuals with acromegaly who didn’t show an adequate response to or could not be treated with pituitary irradiation, surgical resection, or bromocriptine mesylate at the maximum tolerated dose. Sandostatin is also indicated for the treatment of severe diarrhea and flushing episodes associated in individuals with metastatic carcinoid tumors. The drug is used for the treatment of profuse watery diarrhea related to vasoactive intestinal peptide tumors. Seven companies including Sun Pharmaceuticals commercialize generic versions of Sandostatin.

Afinitor/Votubia revenue trends

In 1H17, Afinitor/Votubia generated revenues of around $729 million compared to $732 million in 1H16. In 2Q17, Afinitor/Votubia generated revenues of around $385 million, which reflected a ~5% growth on a YoY basis and 12% growth on a quarter-over-quarter basis. Afinitor is a blockbuster drug from Novartis indicated for multiple cancer types. Afinitor is used for the treatment of advanced hormone receptor-positive (or HR+) human epidermal growth factor receptor-2 negative (or HER2-) in postmenopausal women with metastatic breast cancer. The drug is also indicated for renal cell carcinoma, neuroendocrine tumors of the stomach and intestine, and angiomyolipoma. Afinitor is also used in individuals with a genetic disorder known as tuberous sclerosis complex (or TSC) who have brain tumors called subependymal giant cell astrocytoma (or SEGA) where the tumor cannot be removed entirely by surgery.

In the renal cell carcinoma drugs market, Novartis’s Afinitor competes with Bristol-Myers Squibb’s (BMY) Opdivo and Exelixis’s (EXEL) Carbometyx.

Revenue trends

In 1H17, Exjade/Jadenu reported revenues of around $514 million, which is a ~5% increase on a YoY basis. In 2Q17, Exjade/Jadenu generated revenues of around $267 million, which reflected ~5% growth on a YoY basis and 8% growth on a quarter-over-quarter basis. The increasing uptake of Exjade/Jadenu film-coated tablets contributed to the revenue growth in 2Q17. In May 2017, the U.S. Food and Drug Administration (or FDA) approved Jadenu sprinkle granules. In July 2017, Novartis also filed a regulatory application to the European Commission for approval of Exjade granules in the European Union. The approval of Exjade in Europe is expected by the end of 2017.

Exjade/Jadenu is used for the treatment of chronically elevated iron levels in the blood due to repeated blood transfusions in patients aged two years or above. The drug is also used for the treatment of chronic iron overload in individuals aged ten years or above with non-transfusion-dependent thalassemia syndromes. The Pharmaceutical ETF (PPH) invests ~6.7% of its total portfolio in Novartis. Pfizer (PFE), Novartis’s peer in the oncology drug market, makes up ~5.5% of PPH’s total portfolio holding.