Behind Xyrem’s Solid Demand Trends in 2017

In 2Q17, Jazz Pharmaceuticals’ (JAZZ) Xyrem reported revenues of ~$298 million, which represented a YoY (year-over-year) growth of ~6% and sequential growth of ~9%.

Aug. 22 2017, Updated 7:37 a.m. ET

Xyrem financial performance

In 2Q17, Jazz Pharmaceuticals’ (JAZZ) Xyrem reported revenues of ~$298 million, which represented a YoY (year-over-year) growth of ~6% and sequential growth of ~9%. The drug reported total sales worth $570 million in 1H17, which represented a YoY rise of ~8%.

For fiscal 2017, JAZZ expects Xyrem to report revenues in the range of $1.20 billion–$1.23 billion. Notably, the company reduced its projected range for Xyrem’s fiscal 2017 sales from $1.22 billion–$1.25 billion in its 1Q17 earnings conference call.

In 2Q17, JAZZ witnessed a YoY growth of ~2% in the volume of Xyrem bottles sold. But the demand for Xyrem continues to be negatively affected by the decline in government-sponsored patients, while commercial payers have been steadily approving reimbursements for Xyrem in 2017. In 2017, many of the Medicare Part D patients who hit what is referred to as “the donut hole” have discontinued Xyrem therapy.

Despite these pressures, JAZZ had around 13,025 patients actively using Xyrem in 2Q17, mainly due to favorable commercial reimbursement trends. The company expects Xyrem’s volume sales to increase in 2H17, while its YoY volume growth is expected to be in the low- to mid-single digits for fiscal 2017.

Narcolepsy market opportunity

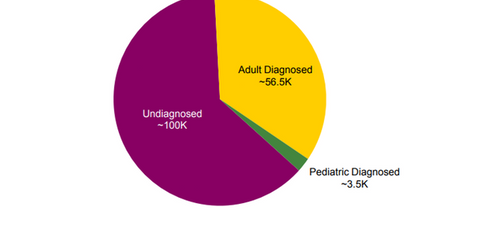

The above chart shows that ~160,000 people in the US are afflicted by narcolepsy, of which 100,000 have yet to be diagnosed. These statistics have led JAZZ to increase its focus on creating awareness of the disease and to support its diagnosis of patients.

The company’s awareness program resulted in ~1.0 million website sessions in 2Q17, while 38,000 narcolepsy patients with cataplexy were screened through these efforts. The company also witnessed 26,000 lookups by physicians on the company’s narcolepsy awareness website pages.

An expanding field sales force

JAZZ has also expanded its field sales force for sleep disorders from five to 11. The expanded team helps physician offices complete reimbursement-related formalities while accessing Xyrem. It’s been noted that the success of this team has been reflected in higher payer approval rates and more filled prescriptions compared with national averages.

Xyrem should thus help JAZZ pose solid competition to other narcolepsy players such as Teva Pharmaceuticals (TEVA), Mylan (MYL), and Allergan (AGN). The PowerShares Dynamic Pharmaceuticals Portfolio (PJP) has ~2.4% of its total portfolio holdings in JAZZ.

In the next part, we’ll discuss the label expansion programs for Xyrem in greater detail.