These Factors Could Affect Vale Stock in 2H17

After significantly outperforming its peers in 1Q17, Vale’s (VALE) performance deteriorated in 2Q17.

Aug. 9 2017, Updated 5:16 p.m. ET

Vale’s performance in 2Q17

After significantly outperforming its peers in 1Q17, Vale’s (VALE) performance deteriorated in 2Q17. While a sound operational performance and corporate governance overhaul supported its stock in 1Q17, some negative incidents led to the weakness in the second quarter. First, Vale’s 1Q17 results in April 2017 came in weaker than expected. Another factor that negatively impacted the stock performance in 2Q17 was the news about the involvement of Brazil’s (EWZ) president, Michel Temer, in a corruption scandal, which led to political turmoil in the country. The Brazilian president’s business-friendly policies had boosted Brazilian stocks previously.

Vale’s 2Q17 results

Vale released its 2Q17 results on July 27, 2017. Its earnings dropped sharply from $1.1 billion in 2Q16 to just $16 million in 2Q17. Asset write-downs, lower commodity prices (COMT), and financial losses led to this huge earnings decline for the company. Its adjusted earnings per share (or EPS) of $0.18, however, beat the analyst estimate by $0.01. The company remains committed to reducing its debt going forward. It also reduced its net debt in 2Q17.

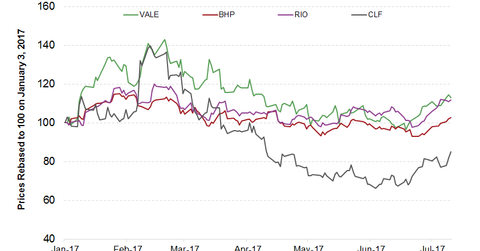

Year-to-date, Vale has risen 34% as of August 8, 2017. BHP Billiton (BHP), Rio Tinto (RIO), and Cliffs Natural Resources (CLF), on the other hand, have had stock gains of 16%, 23%, and -11%, respectively.

In this series

In this series, we’ll discuss Vale’s strategy to deal with the current volatile commodity price environment. We’ll also discuss the performance of its different segments in 2Q17 and analyze their outlook going forward. Since debt is one of the biggest investor concerns for the company, we’ll see what the company is doing to reduce its debt. We’ll also discuss what Wall Street analysts are thinking about the company’s stock.

We’ll wrap up by comparing Vale’s valuation with those of peers. In the next part, we’ll look at Vale’s iron ore division.