Will China’s Disappointing July Trade Deflate Metal Bulls?

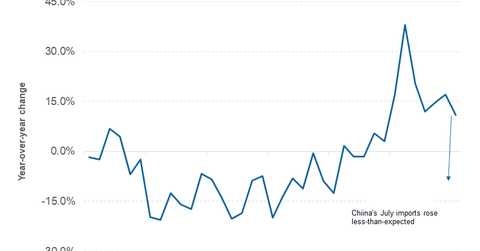

On August 8, China released its trade data for July. The country’s exports in dollar terms rose 7.2% compared to July 2016 while imports rose 11%.

Aug. 8 2017, Published 10:07 a.m. ET

China’s July trade data

On August 8, China released its trade data for July. The country’s exports in dollar terms rose 7.2% compared to July 2016 while imports rose 11%. China’s July trade data was worse than what markets were expecting. Notably, before the July trade data, most Chinese economic indicators—including the PMI (purchasing managers’ index) and real estate investment data—came in better than expected.

Chinese economy

As most data points showed stability in the world’s second largest economy, we saw an uptick in metal prices (DBC). It’s worth noting that China is the dominant player in all of the industrial metals, from aluminum to copper. Over the last couple of years, the impact of China’s slowdown was visible in most commodities.

China impacts metals in different ways. In aluminum (AA) and steel, Chinese exports affect global markets. As domestic demand growth rates slowed down, China’s excess production flooded international markets. US producers—including U.S. Steel (X) and AK Steel (AKS)—have been decrying allegedly subsidized Chinese steel exports for quite some time.

However, copper is a different story, and we need to look at China’s imports. The country isn’t self-sufficient for its copper needs, and it’s the largest copper importer (FCX).

Series overview

Over the last couple of months, a better demand environment from China has boosted metal prices. We saw an increase in metal prices from iron ore to copper on expectations of higher Chinese demand. In this article, we’ll see what China’s July trade data means for metal bulls.

Let’s begin by looking at China’s July steel exports in the next part of this series.