Will Bond Yields Continue to Fall amid Geopolitical Tensions?

Bonds, especially U.S. Treasuries (GOVT), are considered one of the safest assets in which to park your funds in times of uncertainty.

Aug. 14 2017, Updated 11:06 a.m. ET

Bond market demand increases

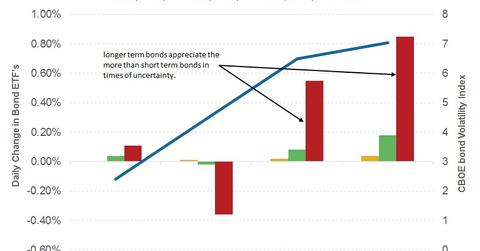

Bonds, especially U.S. Treasuries (GOVT), are considered one of the safest assets in which to park your funds in times of uncertainty. This concept has proved to be correct again as demand for fixed income (BND) assets increased in the last few trading sessions after tensions between the United States and North Korea escalated. Volatility in the bond market, as measured by the CBOE (Chicago Board Options Exchange) ten-year U.S. Treasury note, rose 20.4% in the last four trading sessions.

US government securities enjoy the highest rating and the lowest default risk among all the asset classes. That’s the main reason that demand for these securities rises during times of uncertainty (VXX). When demand increases, prices of bonds rise, and the required yield, which is the interest rate that investors demand to invest in these bonds, falls lower.

Which bond is the safest?

Usually, demand for longer maturity (TLT) bonds increases more than short-term bonds (SHY), since long-term bonds offer safety for an extended period. The U.S. Government 30-Year Bond has risen from 154.09 basis points on August 4, 2017, to 155.58 basis points at the close of business on August 10, 2017. The yield on the same security has fallen to 2.78% from 2.84% in the last four trading sessions.

What’s next for the bond markets?

The bond markets have been in the spotlight in the last few months as the Fed continued to tighten its monetary policy. The recent warning from former Fed chair Alan Greenspan about a bond market bubble comes back in focus since bond prices are expected to increase and bond yields could fall further if the current geopolitical risk escalates. Most likely, no one will talk about interest rate hikes or the Fed’s balance sheet shrinking until this geopolitical risk subsides.