What Happened to Novartis’s Innovative Medicines Business in 2Q17?

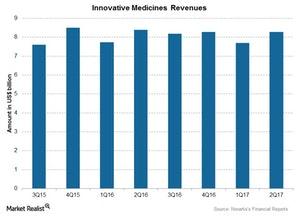

Novartis’s Innovative Medicines segment contributed over 67% of NVS’s total revenues at nearly $8.3 billion for the quarter.

Aug. 30 2017, Updated 6:06 p.m. ET

Innovative medicines business

Novartis’s (NVS) Innovative Medicines segment includes two business units: Novartis Pharmaceuticals and Novartis Oncology. This segment includes products from various therapeutic areas, including cardiology and metabolics, dermatology, immunology, neuroscience, oncology, respiratory, and other established medicines.

This segment contributed over 67% of NVS’s total revenues at $8.28 billion for the quarter.

Segment performance

Revenues in this segment included a 1% growth in operating revenues, consisting of 7% volume growth, a 4% fall in generic products due to competition, and a 2% fall due to pricing issues and generic competition.

This segment’s revenue growth in 2Q17 was driven by the strong performance of Afinitor, Cosentyx, Entresto, Jakavi, Promacta-Revolade, Tafinlar and Mekinist, Tasigna, and Xolair. This growth was partially offset by lower sales of Gleevec-Glivec and Sandostatin.

Gilenya and Tafinlar-Mekinist

Gilenya is an oral drug for multiple sclerosis. Gilenya reported revenues of $837 million in 2Q17, which was 3% higher than in 2Q16. Competitors include Tecfidera from Biogen (BIIB) and Aubagio from Sanofi (SNY).

The Tafinlar-Mekinist combination is approved for the treatment of BRAF V600+ metastatic melanoma. The combination reported revenues of $216 million in 2Q17, which was 25.5% higher than its $172 million in 2Q16, due to strong performance across all markets.

Tasigna, Cosentyx, and Lucentis

Tasigna is approved for the treatment of chronic myeloid leukemia. Tasigna reported revenues of $463 million in 2Q17, which was 1% higher than in 2Q16. This growth was driven by strong sales across the US as well as outside US markets. Competitors include Pfizer’s (PFE) Bosulif.

Cosentyx is a monoclonal antibody that reported revenues of $490 million in 2Q17, which represents 90% operational growth over its $260 million in 2Q16. This growth was driven by strong demand across all indications.

Lucentis is an ophthalmology drug that reported revenues of $477 million in 2Q17, which represents 5% growth in operating revenues as compared with 2Q16.

To divest company-specific risks, investors can consider ETFs like the PowerShares International Dividend Achievers ETF (PID), which has 1.4% of its total assets in Novartis (NVS). PID also has 1.4% in Sanofi (SNY), 1.3% in Novo Nordisk (NVO), and 0.9% in Teva Pharmaceuticals (TEVA).