Walmart Beats Fiscal 2Q18 Bottom-Line Analyst Estimates

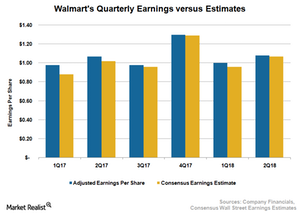

Walmart (WMT) reported its fiscal 2Q18 results on August 17. Walmart’s adjusted earnings per share of $1.08 beat Wall Street’s estimate and increased 1% year-over-year.

Aug. 21 2017, Updated 10:57 a.m. ET

EPS versus consensus

Walmart (WMT) reported better-than-expected fiscal 2Q18[1. fiscal 2Q18 ended July 31, 2017] results on August 17, 2017. Walmart’s adjusted EPS (earnings per share) of $1.08 beat Wall Street’s estimate and increased 1% YoY (year-over-year).

Fiscal 2Q18 marked the company’s second straight quarterly bottom-line growth in two years. Walmart has exceeded analysts’ EPS expectations for the past eight consecutive quarters.

In comparison, rival Target’s (TGT) 2Q17 bottom line also surpassed analyst estimates but remained flat on a YoY basis. The company’s bottom line benefited from a turnaround in sales, offset by higher costs associated with the fulfillment of online orders.

Costco (COST) is projected to see healthy EPS growth in its upcoming quarter, benefiting from its industry-leading sales and incremental savings.

What drove Walmart’s EPS beat?

Walmart’s EPS increased despite the company’s increased investments into its business and more intense competition from Amazon (AMZN), Aldi, and other deep discount stores. Walmart’s healthy top-line performance, driven by improved store traffic at its US (SPY) stores and solid digital business, boosted its bottom-line growth. However, increased price and e-commerce investments, as well as a higher effective tax rate, remained a drag.

Going forward, Walmart’s EPS is likely to benefit from higher sales, driven by continued growth at its Walmart U.S. division, including its online and physical stores. However, low pricing, increased competition, and investments into the digital arm could pressure margins and in turn, its EPS growth.

The company’s management projects its fiscal 3Q18 EPS to be in the range of $0.90–$0.98. The company raised the lower end of its expected fiscal 2018 EPS. Walmart now expects its adjusted EPS to be in the range of $4.30–$4.40 compared to its earlier guidance of $4.20–$4.40.