Ulta Beauty Stock: Why It Fell despite Beating 2Q17 Expectations

Ulta Beauty (ULTA) stock fell 9.1% to $212.36 on August 25, 2017, in reaction to the company’s results for fiscal 2Q17, which ended on July 29, 2017.

Aug. 30 2017, Updated 7:36 a.m. ET

Stock fell after 2Q17 results

Ulta Beauty (ULTA) stock fell 9.1% to $212.36 on August 25, 2017, in reaction to the company’s results for fiscal 2Q17, which ended on July 29, 2017. The company announced those results after the close of the financial markets on August 24, 2017.

Ulta Beauty exceeded analysts’ sales and earnings expectations. However, investors were disappointed with the slowdown in the company’s same-store sales for the quarter. In the fiscal 2Q17 conference call, CEO (chief executive officer) Mary Dillon indicated that same-store sales were impacted since the company decided not to run incremental promotions in July. That choice reflected its focus on earnings growth through margin expansion over same-store sales growth.

YTD movement

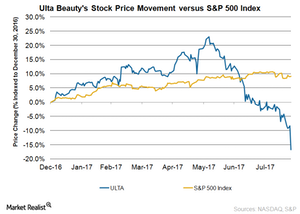

With the stock falling after the fiscal 2Q17 results, it has now fallen 16.7% on a YTD (year-to-date) basis as of August 25. The beauty retailer has underperformed the S&P 500 Index, which has risen 9.1% as of August 25.

Ulta Beauty has been consistently delivering double-digit, same-store sales growth over the past 11 quarters. But growing competition from Amazon (AMZN) appears to be a big threat for brick-and-mortar retailers. Also, Ulta Beauty is facing competition from department stores such as Macy’s (M) and JCPenney (JCP). Macy’s is focusing on the beauty space through its Bluemercury business. JCPenney is expanding its presence in the beauty market through its Sephora stores within JCPenney locations.

Series overview

In this series on Ulta Beauty’s fiscal 2Q17 results, we’ll analyze the drivers behind the company’s sales and earnings growth. We’ll also look at the company’s margins and the impact of the quarterly results on analysts’ recommendations.

Let’s start by taking a closer look at the company’s earnings.