Using Implied Volatility to Forecast Oasis’s Stock Price Range

Oasis Petroleum (OAS) stock’s current implied volatility is ~ 50.22%, which is ~2.08% higher than its 15-day average of 49.19%.

July 25 2018, Updated 9:04 a.m. ET

Implied volatility

Oasis Petroleum (OAS) stock’s current implied volatility is ~ 50.22%, which is ~2.08% higher than its 15-day average of 49.19%. In comparison, the Energy Select Sector SPDR ETF’s (XLE) implied volatility is ~17.8%, ~2.49% lower than its 15-day average of $18.25.

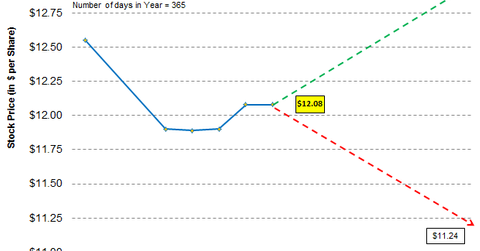

Oasis Petroleum: Stock price range forecast

Assuming that prices are normally distributed, with a standard deviation of one (or a probability of 68.2%) and based on Oasis Petroleum’s implied volatility of ~50.22%, we can expect Oasis Petroleum’s stock to close between $11.24 and $12.92 in the week ended July 27.

OAS’s peer Hess Corporation (HES) has a stock price range of $61.06–$67.42 in the week ended July 27 based on its implied volatility of 35.69%. Concho Resources (CXO) has a stock price range of $136.30–$150.52 based on its implied volatility of 35.82% in the same period.

Whiting Petroleum (WLL) has a stock price range of $45.71–$53.59 in the week ended July 27, based on its implied volatility of 57.24%.