Edwards Lifesciences’ Mitral Regurgitation Segment

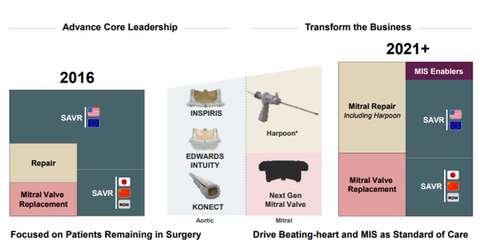

To diversify its focus beyond aortic structural heart conditions, Edwards Lifesciences (EW) acquired CardiAQ Valve Technologies in August 2015.

Aug. 3 2017, Updated 9:09 a.m. ET

Mitral regurgitation patients

To diversify its focus beyond aortic structural heart conditions, Edwards Lifesciences (EW) acquired CardiAQ Valve Technologies in August 2015. The deal added an investigational transcatheter mitral valve replacement system to Edwards Lifesciences’ product portfolio. In February 2017, however, the company paused enrollment in the feasibility study aimed to evaluate the transcatheter mitral valve. It resumed enrollment later in 1Q17, and the company has been delivering this therapy to patients transseptally in 2Q17. The company now expects to launch the device in Europe by 2019.

Edwards Lifesciences has projected that around 2.5 million people in the United States suffer from moderate-to-severe symptomatic mitral diseases. Of those patients, only 50,000 opt for surgery. That implies that there is a solid opportunity for Edwards Lifesciences’ transcatheter mitral valve therapy in resolving patients’ mitral regurgitation. If the investigational device manages to capture this opportunity, it will have a beneficial impact on Edwards Lifesciences stock and the stock of the Vanguard Mid-Cap ETF (VO). Edwards Lifesciences makes up about 0.68% of VO’s total portfolio holdings.

Moderate-to-severe mitral repair opportunity

On January 23, 2017, Edwards Lifesciences acquired Valtech Cardio, adding Cardioband, an investigational transcatheter mitral and tricuspid valve repair system, to its product portfolio. Cardioband is expected to enable Edwards Lifesciences to compete effectively with other structural heart condition players such as Abbott Laboratories (ABT), Medtronic (MDT), and Boston Scientific (BSX).

Based on positive clinical trial results, Edwards Lifesciences plans to begin the US Investigational Device Exemption trial in the near future. However, the delay in building a dedicated clinical team has resulted in a slower-than-expected commercial ramp-up for Cardioband in the first half of 2017.

Edwards Lifesciences, however, expects Cardioband to become a major first-line therapy for mitral repair patients in future years. The revenue contribution of Cardioband in 2017 is expected to be lower than the $10.0 million–$15.0 million range previously projected by the company. Earnings per share dilution due to the acquisition of Valtech Cardio will be higher than the $0.10 previously projected for 2017.