Marriott’s Revenue Is Now Expected to Go This Way in 2017

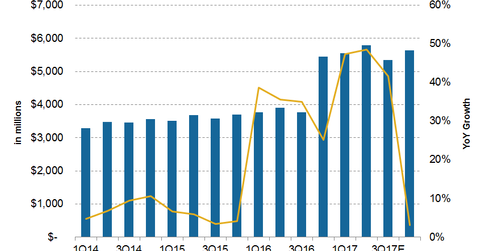

In 2Q17, Marriott’s revenues grew 49% YoY to $5.8 billion, compared with $3.9 billion in 2Q16, due to higher fee revenues and RevPAR and room growth.

Aug. 9 2017, Updated 1:35 p.m. ET

Marriott’s 2Q17 revenues

In 2Q17, Marriott International’s (MAR) revenues grew 49% YoY (year-over-year) to $5.8 billion, compared with its revenues of $3.9 billion in 2Q16, due to higher fee revenues and RevPAR and room growth.

Marriott’s base management fees rose 53% YoY to $285 million. Franchise fees rose 52% YoY to 416 million, and incentive management fees rose 57% YoY to $148 million. Owned, leased, and other revenue rose 121% YoY to $458 million. Cost reimbursements rose 43% YoY to 4.5 billion.

Outlook

For 3Q17, Marriott expects its total fee revenues to grow by 58.5%–61.4% to $810 million–$825 million. Owned, leased, and other revenues are expected to fall, however, to $75 million from $279 million in 3Q16, due to a negative impact from previously sold hotels.

For 4Q17, Marriott expects its total fee revenues to grow 12.8%–19.0% to $804 million–$849 million. Owned, leased, and other revenues are expected to fall, however, to $97 million from $536 million in 4Q16, due to a negative impact from previously sold hotels.

MAR’s fiscal 2017

Marriott’s better-than-expected 1H17 performance should help the company record a good 2017. The company expects its total fee revenues for fiscal 2017 to grow 10.0%–13.5% to $3.2 billion–$3.3 billion. Owned, leased, and other revenues are expected to fall to $355 million.

Notably, investors can gain exposure to the hotel sector by investing in the First Trust Consumer Discretionary AlphaDEX Fund (FXD), which has ~15% in the hotel, restaurants, and leisure sector, including 1.1% apiece in Wyndham (WYN) and Marriott (MAR) and 0.55% in Hyatt (H). FXD has no holdings in Hilton Worldwide Holdings (HLT).

In the next part, we’ll look at how Marriott’s new partnership with Alibaba could help improve growth.