Imbruvica Could Significantly Drive AbbVie’s Revenue Growth

In 2Q17, AbbVie’s (ABBV) Imbruvica generated revenues of around $626.0 million, which reflected a ~43.0% rise YoY and a ~14.0% rise QoQ.

Aug. 7 2017, Updated 7:38 a.m. ET

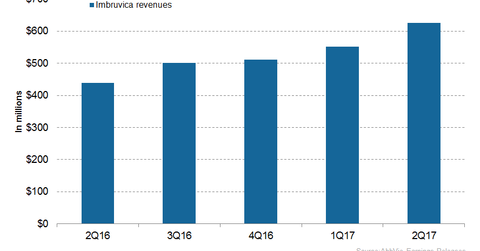

Imbruvica revenue trends

In 2Q17, AbbVie’s (ABBV) Imbruvica generated revenues of around $626.0 million, which reflected a ~43.0% rise YoY (year-over-year) and a ~14.0% rise QoQ (quarter-over-quarter).

In February 2014, the FDA (U.S. Food & Drug Administration) first approved Imbruvica for the treatment of chronic lymphocytic leukemia (or CLL). Imbruvica was jointly developed by AbbVie and Johnson & Johnson (JNJ). According to AbbVie’s estimates, Imbruvica currently leads the market share among first-line CLL patients globally. Imbruvica holds a market share of ~24.0% among new patient starts and 33.0% of the total patient market share worldwide. AbbVie also estimated that around ~70.0% of patients in second-line CLL use Imbruvica therapy.

The above graph represents the revenue trajectory of Imbruvica from 2Q16 to 2Q17. To know more about Imbruvica, please refer to Imbruvica May Witness Significant Revenue Growth in 2017.

Recent regulatory filing

In April 2017, the FDA accepted AbbVie’s supplemental New Drug Application (or sNDA) for Imbruvica for the treatment of individuals with chronic graft-versus-host disease (or cGVHD) who have previously failed in one or more lines of systemic therapy. In June 2016, the FDA granted a breakthrough therapy designation to Imbruvica as a potential therapy for cGVHD.

Long-term clinical outcomes of Imbruvica

In June 2017, AbbVie presented the long-term follow-up outcomes from the Phase 3 RESONATE trial. The trial demonstrated continued survival rates. In June 2017, AbbVie presented the long-term follow-up outcomes from the Phase 3 RESONATE trial. The trial demonstrated continued survival rates in individuals with relapsed/refractory CLL/small lymphocytic leukemia (or SLL) who were treated with Imbruvica (ibrutinib) for up to four years. According to the trial, 59.0% of relapsed/refractory CLL/SLL patients who were under Imbruvica therapy showed significantly longer progression-free survival (or PFS). Further, among Imbruvica treated patients, 74.0% of them achieved a three-year overall survival (or OS), and 91.0% of them achieved the overall response rate (or ORR).

AbbVie’s Imbruvica could face stiff competition from Gilead Sciences’ (GILD) Zydelig, Roche Holdings’ (RHHBY) Rituxan, and others. The SPDR S&P 500 ETF (SPY) invests ~0.53% of its total portfolio holdings in AbbVie.