How Walmart Has an Edge Over Competition

As competition heats up in the grocery business, Walmart (WMT) is leveraging its strong retail presence, which gives the company an edge over the competition.

Aug. 22 2017, Updated 10:05 a.m. ET

What differentiates Walmart?

As competition heats up in the grocery business, Walmart (WMT) is leveraging its strong retail presence, which gives the company an edge over the competition. Walmart has more than 4,700 stores across the US (SPY) with a strong foothold in rural areas that Amazon (AMZN) and other retailers lack. Fulfillment of online orders in remote locations could increase the last mile delivery costs for these retailers.

As for Walmart, the company’s strong network of stores, its multichannel offerings, its own fleet of trucks, and its workforce of over a million employees solidify its position against the competition.

Plus, the company’s continued ability to invest in price and the digital business coupled with consumer-friendly services including the expansion of online grocery services to more than 900 stores, two-day free delivery, and pickup discounts makes Walmart a favorite destination to shop.

Walmart US is growing despite competition

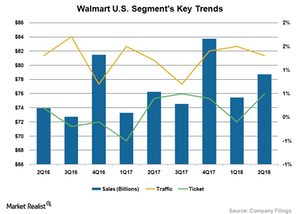

The company’s efforts to ramp up its digital business and the expansion of its online grocery business are showing results, as Walmart’s US segment continues to post healthy sales growth despite stiff competition from grocers including Kroger (KR), Costco (COST), Target (TGT), and now Amazon and Aldi. The company’s US business posted 12 consecutive quarters of positive comps with traffic improving in the past 11 quarters.

During the recently concluded fiscal 2Q18, Walmart’s grocery business in the US marked low-single-digit comps growth with the food category reporting its best quarterly comps in the last five years. Management noted that the food and consumables business saw increased traffic coupled with strong unit growth. Walmart has managed to reduce its supply chain days, which has improved the freshness of its offerings. Besides, the company’s strategic low pricing further boosts its grocery sales growth.

Walmart’s US segment saw 3.3% YoY (year-over-year) growth in sales with a 1.8% increase in comps. The company’s digital business added about 70 basis points to the comps growth thanks to the expansion of its online grocery services.