How Pfizer’s Enbrel and Xeljanz Are Positioned after 2Q17

In August 2017, the Arthritis Advisory Committee of the FDA recommended a positive opinion for the proposed dose of Xeljanz for the treatment of individuals with active psoriatic arthritis.

Sept. 1 2017, Updated 10:36 a.m. ET

Enbrel’s revenue trends

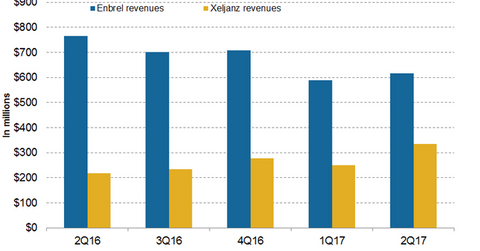

In 2Q17, Pfizer’s (PFE) Enbrel generated revenues of ~$617 million, which reflects an ~19% decline on a year-over-year (or YoY) basis and a 5% decline on a quarter-over-quarter basis. In 1H17, Enbrel generated revenues of ~$1.2 billion.

Amgen (AMGN) markets Enbrel in the US and Canada, and Pfizer commercializes the drug outside the US and Canada.

Xeljanz’s revenue trends

In 2Q17, Xeljanz generated revenues of ~$336 million, which reflects ~55% growth on a YoY basis and 34% growth on a quarter-over-quarter basis. In 1H17, Xeljanz generated revenues of around $336 million compared to $217 million in 1H16.

In August 2017, the Arthritis Advisory Committee (or AAC) of the FDA recommended a positive opinion for the proposed dose of Xeljanz for the treatment of individuals with active psoriatic arthritis.

The recommendation of AAC was in response to Pfizer’s supplemental new drug application (or sNDA) for Xeljanz 5 mg twice daily (or BID), and Xeljanz XR extended-release 11 mg once daily (or QD) for the treatment of individuals with active psoriatic arthritis. The final FDA approval is expected in December 2017.

In June 2017, Pfizer presented the results of the Phase 3b/4 ORAL Strategy trial, which was conducted to investigate the efficacy and safety of Xeljanz 5 mg BID as a monotherapy or in addition to methotrexate for the treatment of individuals with moderate-to-severe rheumatoid arthritis (or RA).

This trial compared this treatment to Humira and methotrexate combination therapy. The ORAL Strategy trial was the first trial conducted by Pfizer for comparison of the efficacies of Xeljanz and Humira.

In the ORAL study, 46.0% of patients on Xeljanz 5 mg BID and methotrexate combination therapy achieved ACR50 (50% improvement according to the American College of Rheumatology scoring). In this study, 38.3% of patients receiving Xeljaz 5 mg BID monotherapy achieved ACR50.

Among patients receiving Humira 40 mg every other week (or EOW) and methotrexate combination therapy, 43.8% of patients achieved ACR50.

Pfizer’s Xeljanz competes with Johnson & Johnson’s (JNJ) Remicade and AbbVie’s (ABBV) Humira. The PowerShares Dynamic Pharmaceuticals Portfolio ETF (PJP) invests ~5.0% of its total portfolio in Pfizer.