How Did United Therapeutics’ Orenitram and Unituxin Perform in 2Q17?

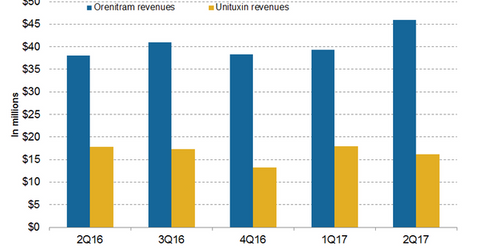

In 2Q17, United Therapeutics’ (UTHR) Unituxin generated revenues of around $16 million, a 10% decline on a year-over-year (or YoY) basis and an 11% decline on a quarter-over-quarter basis.

Aug. 31 2017, Updated 9:08 a.m. ET

Unituxin revenue trends

In 2Q17, United Therapeutics’ (UTHR) Unituxin generated revenues of around $16 million, a 10% decline on a year-over-year (or YoY) basis and an 11% decline on a quarter-over-quarter basis. In 1H17, Unituxin reported revenues of around $30.6 million compared to $31.2 million in 1H16. Unituxin (dinutuximab) is a monoclonal antibody used in combination with a granulocyte-macrophage colony-stimulating factor (or GM-CSF) interleukin-2 (or IL-2) and a 13-cis-retinoic acid (or RA) for the treatment of children with high-risk neuroblastoma who attained a partial response to the previous first-line multi-agent multimodality therapy.

The above chart represents the revenue trajectory of United Therapeutics’ Orenitram and Unituxin from 2Q16 to 2Q17.

Orenitram revenue trends

In 2Q17, Orenitram generated revenues of around $46 million, which reflected ~21% growth on a YoY basis and 17% growth on a quarter-over-quarter basis. In 1H17, Orenitram reported revenues of around $85.3 million compared to $75.5 million in 1H16.

Orenitram (treprostinil) is a prostacyclin vasodilator used for the treatment of individuals with pulmonary arterial hypertension (or PAH) (WHO group 1) for improvement of exercise capacity. In 2013, Orenitram was approved by the U.S. Food and Drug Administration for the treatment of PAH based on FREEDOM-M trial.

United Therapeutics is conducting various trials for the label expansion of Orenitram. Presently, United Therapeutics is conducting its phase IV FREEDDOM-EV trial to evaluate and demonstrate the efficacy of Orenitram in delaying morbidity or time to clinical worsening in individuals with PAH who are already on an approved oral background therapy. To know more about Orenitram, please read Understanding the Sales Potential of United Therapeutics’ Orenitram.

United Therapeutics’ Orenitram competes with GlaxoSmithKline’s (GSK) Flolan, Actelion’s Veletri, Gilead Sciences’ (GILD) Letaris, Bayer’s (BAYZF) Adempas, and others. The SPDR S&P MIDCAP 400 ETF (MDY) invests ~0.36% of its total portfolio holding in United Therapeutics.