Eli Lilly in 2Q17: Performance of New Products

For 2Q17, Basaglar sales were $86.6 million. Of that, $60.0 million was from sales in the US markets, while $27.0 million was from international sales.

July 28 2017, Updated 5:05 p.m. ET

New products from Eli Lilly

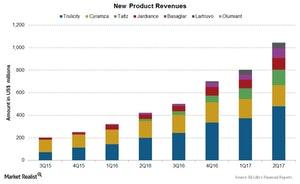

Eli Lilly and Company (LLY) has launched a variety of new products under various franchises. Some of its new products include Basaglar, Cyramza, Jardiance, Lartruvo, Olumiant, Taltz, and Trulicity. Let’s look at these products and their performances for 2Q17.

Basaglar

Basaglar, an insulin glargine injection to control blood sugar levels in patients with Type 1 and Type 2 diabetes, was launched in US markets in December 2016. For 2Q17, Basaglar sales were $86.6 million. Of that, $60.0 million was from sales in the US markets, while $27.0 million was from international sales.

Cyramza

Revenues for Cyramza, an oncology drug used in combination with other drugs for the treatment of metastatic NSCLC (non-small cell lung cancer), advanced gastric cancer, and metastatic colorectal cancer, rose more than 27.0% in 2Q17 to $186.3 million. It came after an increased demand in Japan and Europe for the treatment of metastatic NSCLC and metastatic colorectal cancer.

Jardiance

Jardiance, a drug to lower blood sugar levels in patients with Type 2 diabetes, is part of the Boehringer Ingelheim and Eli Lilly diabetes alliance. Jardiance reported sales of $103.2 million in 2Q17, driven by increased sales in US and international markets.

Lartruvo

Lartruvo, a drug used in combination with doxorubicin for the treatment of patients with advanced soft tissue sarcoma, was launched in US and European markets in 4Q16. It reported revenues of $47.4 million in 2Q17.

Taltz

Taltz was launched in US markets in April 2016 and in European markets in July 2016. Taltz revenues were $138.7 million in 2Q17, which consisted of $124.0 million in sales from US markets.

Trulicity

Trulicity, a drug for improving blood sugar levels in patients with Type 2 diabetes, reported sales of $480.2 million in 2Q17 compared to $201.3 million in 2Q16. The rise was mainly due to a higher demand in US markets where the drug reported sales of $381.0 million in 2Q17.

To divest the company-specific risks, you can consider the VanEck Vectors Pharmaceutical ETF (PPH), which holds 4.6% of its total assets in Eli Lilly. PPH also holds 8.6% of its total assets in Johnson & Johnson (JNJ), 5.2% in Pfizer (PFE), and 4.9% in Sanofi (SNY).