Can Edwards Lifesciences See Robust Net Profit Margin in 2017?

In its 2Q17 earnings conference call, Edwards Lifesciences (EW) projected 2017 adjusted EPS to fall to $3.65–$3.85, which is higher than the previous $3.43–$3.55.

Nov. 20 2020, Updated 10:59 a.m. ET

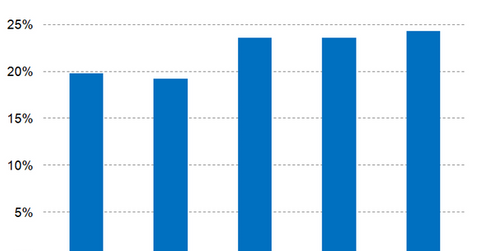

Rise in net profit margins

In its 2Q17 earnings conference call, Edwards Lifesciences (EW) projected 2017 adjusted EPS (earnings per share) to fall to $3.65–$3.85, which is higher than the previously estimated range of $3.43–$3.55. That’s due mainly to a better-than-expected revenue performance as well as excess tax benefits accrued in the first half of 2017. It’s also due to the impact of increased SG&A (selling, general, and administrative) and R&D (research and development) expenses in the second half of 2017. To know more about Edwards Lifesciences’ revenue performance, please refer to Edwards Lifesciences Raised Its Revenue Guidance for Fiscal 2017.

Wall Street analysts have projected Edwards Lifesciences’ 2017 net profit margin to be around 23.6%, which is about 440 basis points higher on a year-over-year basis.

Peers such as Hologic (HOLX), Abbott Laboratories (ABT), and Baxter International (BAX) are expected to report net profit margins of 16.1%, 11.8%, and 11.0%, respectively, in 2017.

Tax benefits and foreign exchange fluctuations

In the first half of 2017, Edwards Lifesciences’ higher stock price led to greater tax deductions. The company has projected its GAAP (generally accepted accounting principles) tax rate for 2017 to fall 17.0%–19.0%, which is lower than the previously projected range of 22.0%–23.0%.

At current foreign exchange rates, the company anticipates a negative sales impact of about $20.0 million for 2017, which is lower than the previously projected negative impact of around $50.0 million.

Besides EPS, the company expects robust free cash flow of $625.0 million–$675.0 million in 2017. If Edwards Lifesciences manages to surpass these EPS and cash flow projections for 2017, it may have a favorable impact on its stock as well as the stock of the Vanguard Mid-Cap ETF (VO). Edwards Lifesciences makes up about 0.68% of VO’s total portfolio holdings.

In the next part of this series, we’ll take a look at the growth prospects for the company’s Surgical Heart Valve Therapy segment.