Why China’s Lower Iron Ore Imports in July Could Be a One-Off

China’s iron ore imports for July 2017 fell 2.4% over July 2016 to 86.3 million tons.

Aug. 29 2017, Updated 7:38 a.m. ET

Customs data and China’s iron ore imports

Because China is the world’s largest consumer of iron ore, it’s important to track China’s iron ore import data. This data also indicates the demand patterns for iron ore among Chinese mills and traders.

China’s imports

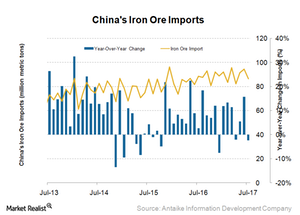

China imported 1.0 billion tons of iron ore in 2016. Its iron ore imports have remained elevated year-to-date (or YTD) despite market participants expecting the contrary. The imports for the first half of 2017 reached 539 million tons, a rise of 9.3% YoY (year-over-year).

However, China’s iron ore imports for July 2017 fell 2.4% over July 2016 to 86.3 million tons. The imports fell more steeply at 8.6% compared to June 2017, which is also its lowest level in the last three months. While its imports slipped in July, the YTD imports still show strong growth at 7.5% YoY.

In our view, the decline in imports in July can be considered a one-off occurrence given the strong YTD data and the recent pick-up in demand as margins in the steel industry remain elevated.

Crackdown benefits imports

The crackdown by Chinese authorities on pollution-emitting steel plants has led to a surge in imports. The majority of domestic Chinese iron ore has a low iron ore content, which increases pollution during the steelmaking process.

Iron ore from Australia and Brazil is of higher quality with fewer impurities. This iron ore is mostly produced by miners (PICK) such as BHP Billiton (BHP), Vale (VALE), Rio Tinto (RIO), and Cliffs Natural Resources (CLF). Because these producers have economies of scale, they can produce iron ore at a much lower cost compared to domestic Chinese producers. Therefore, domestic steel mills find this process to be much more cost-efficient.