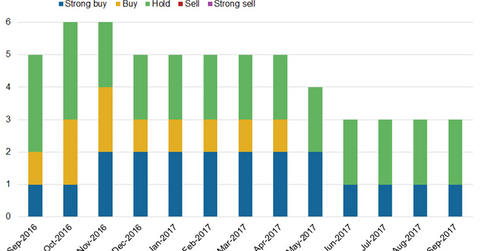

What Analysts Recommend for Novartis in September 2017

Three analysts were analyzing Novartis in September 2017. One analyst recommended a “strong buy,” while the other two recommended a “hold.”

Sept. 18 2017, Published 2:19 p.m. ET

Recent approvals

In August 2017, the US Food and Drug Administration (or FDA) approved Novartis’s (NVS) Kymriah suspension, a chimeric antigen receptor T-Cell (or CAR-T) therapy for the treatment of individuals 25 years or older age with B-cell precursor acute lymphoblastic leukemia (or ALL) that is refractory or in the second relapse. The U.S. FDA approval of Kymriah was based on the results from the phase II ELIANA trial. This trial showed that 83% of the patients on Kymriah achieved complete remission (or CR) with incomplete blood count recovery (or CRi) within three months of infusion.

In June 2017, the European Commission (or EC) approved the label expansion of Zykadia to include use as a first-line treatment for patients with advanced non-small cell lung cancer (or NSCLC) whose tumors are anaplastic lymphoma kinase (or ALK) positive. Approval of the new product and label expansion could boost Novartis’s revenue growth. Novartis’s revenue growth could boost the share prices of the First Trust Value Line Dividend Index Fund (FVD). Notably, FVD has ~0.50% of its total portfolio holdings in Novartis.

Analysts’ recommendations

Three analysts were analyzing Novartis in September 2017. One analyst recommended a “strong buy,” while the other two recommended a “hold.” In September 2017, Novartis had a consensus 12-month target price of $89.50, which represents 4.4% return on investment over the next 12 months.

Peer ratings

Of the 22 analysts analyzing Pfizer (PFE) in September 2017, 50% of the analysts suggested some form of a “buy” rating. Ten of them suggested a “hold,” while one analyst suggested a “strong sell.” In September 2017, Pfizer had a mean 12-month target price of $37.45, which represents a ~5.9% return on investment over the next 12 months.

Of the four analysts analyzing GlaxoSmithKline (GSK) in September 2017, two recommended a “strong buy” and two analysts recommended a “hold.” In September 2017, GlaxoSmithKline had a mean 12-month target price of $46.33, which reflects a ~15.1% return on investment over the next 12 months.

Of the 27 analysts analyzing Celgene (CELG) in September 2017, ~85% of them suggested some form of a “buy” rating, while three analysts suggested a hold and one of them suggested a “sell.” In September 2017, Celgene had a consensus 12-month target price of $153.48, which reflects an ~8.1% return on investment.