A Look at AT&T’s Customer Retention

AT&T (T) noted that it added 2.8 million net wireless subscribers in 2Q17, up from 2.7 million in 1Q17.

Aug. 16 2017, Updated 9:07 a.m. ET

Return to unlimited plans

AT&T (T) reported a strong 2Q17 in which both earnings and revenues blew past analysts’ expectations. Progress in the quarter was underpinned by the company’s expanding media business and its reintroduction of unlimited data plans.

After resisting for months to join T-Mobile (TMUS) and Sprint (S) in unlimited data offerings, AT&T and Verizon (VZ) decided in February to follow the trend set by their smaller competitors. The second quarter of 2017 marked the first full quarter since AT&T joined the unlimited bandwagon, and the move appears to be serving it well.

Churn rate improves

AT&T (T) noted that it added 2.8 million net wireless subscribers in 2Q17, up from 2.7 million in 1Q17.

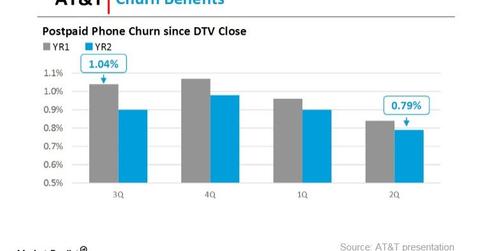

Bundling of wireless and online video services is also helping AT&T improve its customer retention. The company said its postpaid phone subscriber churn fell to 0.79% in 2Q17, as shown in the chart above. Total churn rate in the latest quarter was ~1.0%, better than the churn rate of ~1.2% that Wall Street was expecting.

Lower churn implies lower marketing costs

Churn rate measures the percentage of subscribers defecting to another carrier or canceling a service. In the brutally competitive US (SPY) wireless market, churn rate is a closely watched metric. A declining churn rate not only means improving customer retention but also implies lower marketing costs geared toward winning back former customers.

AT&T posted adjusted EPS (earnings per share) of $0.79 in 2Q17, up from $0.74 in 2Q16 and above the consensus estimate of $0.73. Its revenues dipped 1.8% from 2Q16 to $39.8 billion but still exceeded the consensus estimate.