Why the Yen Depreciated against the Dollar

Last week, the Japanese yen (JYN) succumbed to the US dollar’s strength. The Japanese yen (FXY) closed the week at 110.67.

June 19 2018, Published 8:05 a.m. ET

Japanese yen depreciated against the US dollar

Last week, the Japanese yen (JYN) succumbed to the US dollar’s strength. The Japanese yen (FXY) closed the week at 110.67—compared to the US dollar (UUP) for the week ending June 15. A hawkish FOMC statement and the Bank of Japan’s uneventful policy meeting caused the yen to depreciate. The Bank of Japan chose to leave its ultra-loose monetary policy unchanged and presented a gloomy view of the economy at its May monetary policy meeting, which led to more losses for the Japanese currency.

Japanese equity markets (EWJ) continued to appreciate and posted their second weekly gain in four weeks. The Nikkei 225 (JPXN) posted a weekly gain of 0.69% for the week ending June 15.

Speculators pared bearish bets

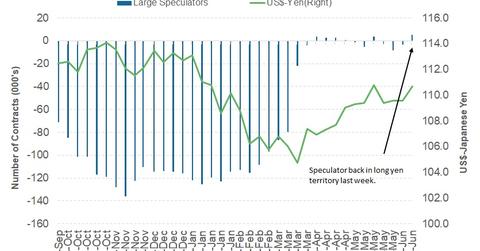

The Japanese yen’s (YCL) speculators decreased their bearish bets for the week ending June 15 and moved into net long positions. According to the latest Commitment of Traders report released on Friday by the Chicago Futures Trading Commission, the yen’s speculators had net long positions of 5,052 contracts on June 12—compared to 3,437 short contracts on June 5.

Yen’s outlook

There aren’t any major economic data releases from the Japanese economy this week. The focus will likely be on the risk-off trading environment. If investors remain risk-averse in response to increased trade tension, we can expect increased demand for the yen due to its value as a safe-haven currency. If investors overlook the trade tension, there could be a continued slide in the yen. The US dollar’s demand will likely dominate the forex markets in the next few weeks.