Where Does Prologis Stand among Its Peers?

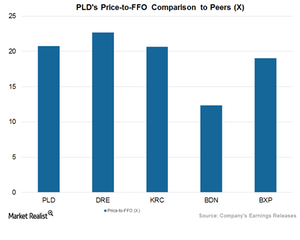

In terms of price-to-FFO multiple, PLD trades at par with most of its peers except Brandywine Realty Trust (BDN).

July 13 2017, Updated 7:36 a.m. ET

Price-to-FFO multiple

Prologis (PLD) can be best evaluated with the help of the price-to-FFO (funds from operations) multiple. For REITs, that multiple carries the same significance as the PE (price-to-earnings) ratio used to calculate a relative value for companies in other industries.

Peer group price-to-FFO multiples

PLD’s current price-to-FFO multiple is 20.75x. The premium valuation for Prologis reflects the company’s ability to consistently return capital value as well as steady dividend yields to investors.

The company’s strategic partnerships and expansion initiatives have led to higher occupancy levels in most of its properties. These revenue-boosting initiatives along with enhanced guidance for 2017 have led to a recent rally in the stock, resulting in a higher price-to-FFO multiple.

In terms of price-to-FFO multiple, PLD trades at par with most of its peers except Brandywine Realty Trust (BDN), which is trading at a lower price-to-FFO multiple of 12.3x. Other peers such as Duke Realty (DRE), Kilroy Realty (KRC), and Boston Properties (BXP) have price-to-FFO multiples of 22.67x, 20.63x, and 19.03x, respectively.

Peer group dividend yield

Prologis offers a next 12-month dividend yield of 3.0%, which is in line with its close competitors. Duke Realty (DRE), Kilroy Realty, and Brandywine Realty Trust (BDN) offer dividend yields of 2.7%, 2.3%, and 3.8%, respectively.

Prologis and its peers make up almost 14.1% of the iShares Cohen & Steers REIT (ICF). Its net asset value stands at $102.10 per share.

In the next and final part of this series, we’ll see how analysts view Prologis.