Oil Rigs: Will Oil Prices Rise More?

On June 23–June 30, the US oil rig count fell by two to 756. The fall was marginal, but it was the first fall after rising for 23 consecutive weeks.

July 7 2017, Updated 7:38 a.m. ET

Oil rigs

On June 23–June 30, the US oil rig count fell by two to 756. The fall was marginal, but it was the first fall after rising for 23 consecutive weeks. On June 30, 2017, following the oil rig count report, US crude oil prices closed 2.5% higher compared to the previous settle price. However, the oil rig count more than doubled compared to the week ending July 1, 2016. However, WTI crude oil prices, on average, fell 7.5% in June 2017—compared to June 2016.

Oil rigs and US oil production

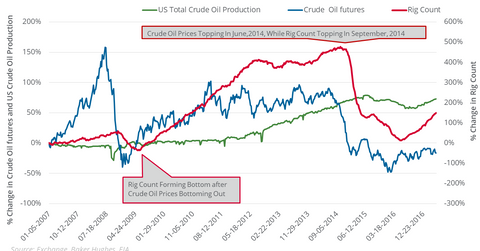

In the week ending June 5, 2015, US crude oil production touched a record high level of 9.6 million barrels per day. WTI crude oil prices started the downturn in June 2014. From June 2014 to date, US crude oil active futures fell 56.1%. Lower oil prices reduced US crude oil output 3.7% from June 5, 2015, and June 23, 2017. Based on the latest oil rig count report, oil rigs have fallen 51.1% since the week ending June 20, 2014.

Why the pattern is important

In the last decade, the oil rig count’s tops and bottoms occurred with a gap of three to six months after oil prices’ highs and lows. For example, US crude oil active futures closed at a record high level of $145.30 per barrel on July 3, 2008. In the week ending November 7, 2008, the oil rig count hit 442—the highest level since the week ending December 24, 1993.

The oil rig count bottomed in the week ending May 27, 2016. In fact, WTI crude oil active futures settled at a 12-year low on February 11, 2016.

Since February 11, 2016, US crude oil (USO) (USL) (DBO) active futures have risen 79.6%, while the oil rig count rose by 440 from the low of 316 in the week ending May 27, 2016. The recovery in oil prices contributed to the rise in the number of active rigs and a 5.9% rise in US crude oil output since the week ending May 27, 2016.

What could make the rise in production sharper?

Apart from a higher oil rig count, new oil production per rig will rise 29.1% in July 2017 compared to July 2016, according to the EIA. Both of these factors, the oil rig count and rig efficiency, could push US crude oil production higher. It will be bearish for crude oil prices and energy ETFs like the Fidelity MSCI Energy ETF (FENY) and the Guggenheim S&P 500 Equal Weight Energy ETF (RYE).