How Prologis Stacks Up against Peers after 2Q17 Earnings

The price-to-FFO multiple is the best way to evaluate Prologis (PLD).

July 25 2017, Updated 9:07 a.m. ET

Price-to-FFO multiple

The price-to-FFO multiple is the best way to evaluate Prologis (PLD). The multiple has the same significance as the PE (price-to-earnings) ratio for companies in other industries.

Peers’ price-to-FFO multiple

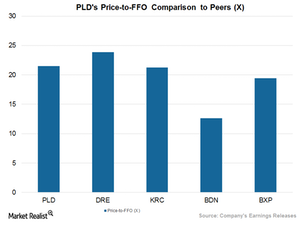

PLD’s current price-to-FFO multiple is 21.51x. The premium valuation for Prologis reflects its ability to regularly return capital value as well as steady shareholder returns in the form of dividends and stock buybacks.

The higher-than-expected top-line and bottom-line results that Prologis reported in 2Q17 likely triggered the company’s stock price rally. The company witnessed significant rent growth and net promote income, which helped in post upbeat profits for the quarter. Prologis also undertook several strategic capital deployments and expansion initiatives and also enhanced its FFO guidance for 2017.

In terms of its price-to-FFO multiple, PLD trades on par with most of its peers like Duke Realty (DRE), Kilroy Realty (KRC), and Boston Properties’ (BXP) carry price-to-FFO multiples of 23.85x, 21.23x, and 19.41x, respectively.

Peer group dividend yield

Prologis offers a next-12-month (or NTM) dividend yield of 2.9%. The ratio is in line with its close competitors. Duke Realty (DRE), Kilroy Realty (KRC), and Brandywine Realty Trust (BDN) offer dividend yields of 2.6%, 2.3%, and 3.7%, respectively.

Prologis and its peers make up almost 14.1% of the iShares Cohen & Steers REIT ETF (ICF). Net asset value (or NAV) stands at $102.1 per share.