How Equity Residential Improved Its Balance Sheet in 2Q17

During 2Q17, Equity Residential (EQR) reported higher-than-expected top-line and bottom-line results backed by robust rent growth and occupancy levels.

Dec. 4 2020, Updated 10:52 a.m. ET

2Q17 performance

During 2Q17, Equity Residential (EQR) reported higher-than-expected top-line and bottom-line results backed by robust rent growth and occupancy levels.

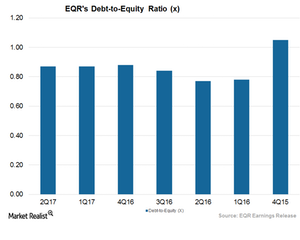

The company has repositioned its properties in high barrier markets with significant income growth. The company maintained a debt-to-equity ratio of 0.87x for 2Q17, which was lower than the industry average of 1.07x. In 1Q17, EQR maintained a debt-to-equity ratio of 0.87x.

Financing activities improved balance sheet

Equity Residential has access to debt at attractive rates. During the 2Q17 earnings conference call, EQR raised the midpoint for its expected unsecured debt offering to $500 million from $400 million.

The enhanced guidance reflects the larger and earlier refinancing activity that the company is scheduled to take up. The refinancing activity is expected to help the company take advantage of current favorable rates.

EQR has also announced plans to use the proceeds from an offering to pay back its outstanding commercial paper and revolver balance. The company’s total outstanding revolving credit and secured debt balance stood at $900 million as of 2Q17. EQR ended the quarter with cash and cash equivalents of $37.7 million.

AvalonBay Communities (AVB), Camden Property (CPT), and Essex Property (ESS) in the REIT sector had debt-to-equity ratios of 0.68x, 0.82x, 0.89x, respectively.

Equity Residential and its peers make up almost 9% of the Vanguard REIT ETF (VNQ), which has a wide product portfolio covering industries like health care, self storage, and residential REITs. VNQ has a net asset value of $81.2 million.