How Bristol-Myers Squibb Stock Has Performed in 2Q17

A look at Bristol-Myers Squibb Headquartered in New York City, Bristol-Myers Squibb (BMY) is an American pharmaceutical company that develops innovative medicines in various therapeutic areas, including cardiovascular, neuroscience, immunoscience, oncology, and virology. Stock price performance While Bristol-Myers Squibb’s stock price has risen ~3.8% in 2Q17, it had fallen ~5.4% year-to-date as of July 7, […]

July 10 2017, Updated 10:37 a.m. ET

A look at Bristol-Myers Squibb

Headquartered in New York City, Bristol-Myers Squibb (BMY) is an American pharmaceutical company that develops innovative medicines in various therapeutic areas, including cardiovascular, neuroscience, immunoscience, oncology, and virology.

Stock price performance

While Bristol-Myers Squibb’s stock price has risen ~3.8% in 2Q17, it had fallen ~5.4% year-to-date as of July 7, 2017.

Analysts’ recommendations

Wall Street analysts estimate that the stock has the potential to return ~3.4% over the next 12 months. Analysts’ recommendations show a 12-month targeted price of $57.14 per share, compared with $55.28 per share on July 6, 2017.

Of the 23 analysts tracking Bristol-Myers Squibb stock, ten recommend “buy,” ten recommend “hold,” and three recommend “sell.” The consensus rating for Bristol-Myers Squibb stands at 2.4, which represents a moderate “buy” for value and long-term investors.

Analysts’ revenue estimates

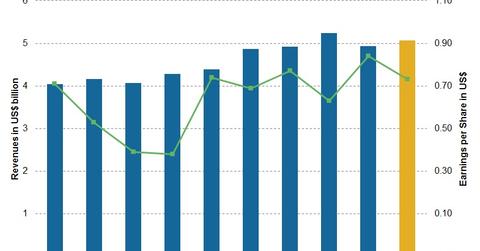

Bristol-Myers Squibb’s revenue has increased over the past few years, following the strong performance of key products Opdivo, Yervoy, Sprycel, and Empliciti from the oncology franchise, Orencia from the immunoscience franchise, and Eliquis from the cardiovascular franchise.

Wall Street analysts expect revenue of $5.1 billion in 2Q17, a 3.9% growth from 2Q16, and earnings per share of $0.73. To divest company-specific risk, investors could consider the PowerShares Dynamic Pharmaceuticals ETF (PJP) which has a 5.0% exposure to Bristol-Myers Squibb, a 6.4% exposure to Akorn (AKRX), a 4.9% exposure to Pfizer (PFE), and a 4.6% exposure to Allergan (AGN).