GSK’s 2Q17 Earnings: Pharmaceuticals Segment

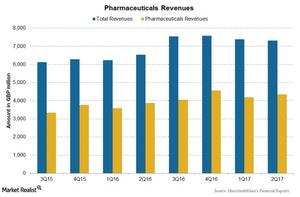

GSK’s Pharmaceuticals segment’s contribution to the company’s total revenues was 59.5% in 2Q17.

Aug. 1 2017, Updated 9:10 a.m. ET

Pharmaceuticals segment

As we discussed earlier in this series, GlaxoSmithKline’s (GSK) Pharmaceuticals segment’s revenues reported 12% growth to ~4.4 billion pounds in 2Q17 compared to 2Q16. This includes operational growth of 3% and a 9% positive impact of foreign exchange.

The segment’s growth was driven by increased sales of HIV products Triumeq and Tivicay as well as new pharmaceutical products such as Relvar/Breo Ellipta and Nucala. The segment’s growth was partially offset by the impact of divestments.

Overall, GSK’s Pharmaceuticals segment’s contribution to the company’s total revenues was 59.5% in 2Q17. The Pharmaceuticals segment comprises various franchises such as HIV Products, Respiratory Products, Immuno-inflammation Products, and Established Products.

HIV Products franchise

GSK’s HIV products are marketed under ViiV Healthcare, a company with GSK as a major shareholder. Pfizer (PFE) and Shionogi are other shareholders in ViiV Healthcare.

HIV products reported 17% growth at constant exchange rates to ~1.1 billion pounds in 2Q17 compared to 2Q16. HIV products comprise more than 25% of the Pharmaceuticals segment’s total sales.

Global Pharmaceuticals franchise

GSK’s Global Pharmaceuticals franchise deals with Respiratory, Immuno-inflammation, and Established products. The Global Pharmaceuticals franchise reported revenues of ~3.2 billion pounds in 2Q17. Its revenues include 4% operational growth in respiratory sales to 1.8 billion pounds.

This trend represents 9% operational growth in Immuno-inflammation Products sales to 93 million pounds and a 7% decline in Established Pharmaceuticals sales at constant exchange rates to ~1.4 billion pounds during 2Q17.

To divest any company-specific risk, investors can consider the First Trust Value Line Dividend ETF (FVD), which holds 0.5% of its total assets in GlaxoSmithKline. FVD also holds 0.5% of its total assets in Abbott Laboratories (ABT), 0.5% in Eli Lilly & Co. (LLY), and 0.5% in Pfizer (PFE).