Granular Urea versus Prilled Urea Last Week

Last week, granular urea prices moved higher, which helped bring some relief to urea producers. But the falling global ammonia prices remained a challenge.

July 17 2017, Updated 3:36 p.m. ET

Urea

Last week (ended July 14, 2017), granular urea prices moved higher, which helped bring some relief to urea producers. But falling global ammonia prices remained a challenge for nitrogen producers (XLB) like CF Industries (CF), CVR Partners (UAN), Terra Nitrogen (TNH), and PotashCorp (POT). Meanwhile, prilled urea prices fell.

Granular urea

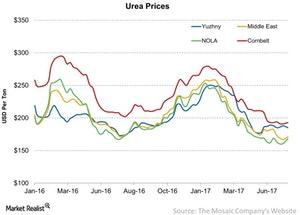

Overall granular urea rose an average of 2.6% last week on a week-over-week basis at the three locations below. In NOLA (New Orleans), urea prices rose 4.4% to $152 per metric ton, up from $146 per metric ton one week previously. Urea prices in the US Corn Belt rose 1.1% to $175 per metric ton, up from $173 per metric ton.

On a YoY (year-over-year) basis, granular urea prices in NOLA rose 1% but fell 7% in the Corn Belt.

In the Middle East, granular urea prices rose 2.4% to $171 per metric ton, up from $167 per metric ton one week previously.

Prilled urea

While the granular urea prices at these locations were positive, this was not the case for prilled urea last week. Prilled urea prices in Yuzhny fell 1.6% to $185 per metric ton, down from $188 per metric ton one week previously.

On a YoY basis, prilled urea prices in Yuzhny rose 6% last week.

Next, we’ll discuss natural gas price movements.