Gold-Platinum Ratio: Is Platinum a Long-Term ‘Buy’?

When reading the platinum market, it’s important to analyze the comparative performance of platinum and gold by using the gold-platinum ratio or spread.

July 24 2017, Published 11:52 a.m. ET

Platinum market analysis

When reading the precious metal market, platinum and palladium are often left on the side, while gold and silver take the front seats. In this series, we’ll concentrate on platinum and palladium and their relationship with gold.

Platinum has been a precise downward streak over the past ten years. Platinum used to be more expensive than gold. As a result, it was given a higher pedestal than gold in the jewelry market. Platinum bottomed close to $800 during the 2008 crisis. It rose and almost doubled in price by 2010.

Platinum didn’t stay at $800 for long. It could have a potential upswing in the longer run. Platinum is used extensively in engines for diesel-based cars. It’s headed for a surplus for the third straight year.

Gold-platinum spread

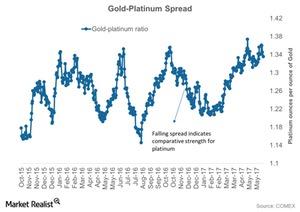

When reading the platinum market, it’s important to analyze the comparative performance of platinum and gold by using the gold-platinum ratio or spread. The spread is a measurement of the number of platinum ounces it takes to buy a single ounce of gold.

The higher the spread goes, the weaker platinum (PPLT) becomes compared to gold (GLD). A declining ratio indicates the relative strength of platinum over gold.

As the above chart shows, the higher the spread rises, the weaker platinum (PPLT) becomes compared to gold (GLD). A declining ratio indicates the relative strength of platinum over gold.

The gold-platinum spread was ~1.34 on July 19, 2017. The RSI (relative strength index) level for the gold-platinum spread is at 45.

Precious metal mining companies that rise and fall with these metals include Eldorado Gold (EGO), Harmony Gold (HMY), AngloGold Ashanti (AU), and Alacer Gold (ASR).