GlaxoSmithKline’s 2Q17 Earnings: Vaccines Business

GSK’s Vaccines business reported 16.0% growth to ~1.1 billion pounds in 2Q17, including 5.0% growth at constant exchange rates and 11.0% positive impact of foreign exchange.

Aug. 2 2017, Updated 9:07 a.m. ET

Vaccines business

GlaxoSmithKline’s (GSK) Vaccine business is one of the company’s key growth areas. GSK also acquired its Meningitis and Other Vaccines business from Novartis (NVS). The revenues were driven by the strong performance of meningitis vaccines, influenza vaccines, and established vaccines.

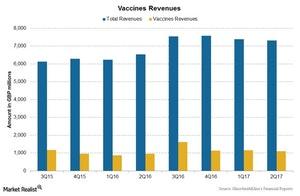

The chart below shows revenues for the Vaccines Segment over the last few quarters.

Performance of GSK’s Vaccines business

GSK’s Vaccines business reported 16.0% growth to ~1.1 billion pounds in 2Q17, including 5.0% growth at constant exchange rates and 11.0% positive impact of foreign exchange. The Novartis acquisition has improved sales for the Vaccines business, mainly driven by the sales of meningitis vaccine Bexsero in the US, Europe, and international markets. The Vaccines business also benefited from sales of Menveo in its European and international markets.

The US markets reported 22.0% growth in revenues to 316.0 million pounds during 2Q17. This included an operational increase of 12% and a positive impact of foreign exchange.

The growth in revenues from the US markets was mainly driven by the strong performance of Bexsero. Its revenue growth also resulted from the robust performance by Menveo from its Meningitis portfolio, as well as Infanrix and Pediarix from the Established Vaccines portfolio. This growth was partially offset by lower sales of Rotarix.

The company’s European market reported 21.0% growth to 394.0 million pounds during 2Q17. This included an operational increase of 10.0% and a positive impact of foreign exchange.

The growth in GSK’s European market was mainly driven by the strong performance of Bexsero and Menveo from the Meningitis portfolio; Infanrix, Pediarix, and Rotarix from the Established Vaccines portfolio; and Fluarix and FluLaval from the Influenza Vaccines franchise. Its growth was partially offset by lower sales of other products in the Established Vaccines franchise.

The international market sales increased 6.0% on reported basis to 401.0 million pounds in 2Q17. This included a 5.0% decrease in revenues at constant exchange rates, which was more than offset by a positive impact of foreign exchange. GSK’s vaccines except for Bexsero, Boostrix, and Cervarix reported lower revenues during 2Q17.

To divest company-specific risks, investors can consider ETFs like the Vanguard FTSE All-World Ex-US ETF (VEU), which holds 0.8% of its total assets in GlaxoSmithKline. VEU also holds 0.8% in Novartis (NVS), 0.8% in Roche Holdings (RHHBY), and 0.4% in Sanofi (SNY).