GlaxoSmithKline’s 2Q17 Earnings: Business Segments

GSK reported operational growth of 3% in its revenues to ~7.3 billion pounds for 2Q17.

Aug. 1 2017, Updated 7:41 a.m. ET

GlaxoSmithKline’s business segments

GlaxoSmithKline (GSK) is divided into three business segments:

- Pharmaceuticals segment

- Vaccines segment

- Consumer Healthcare segment

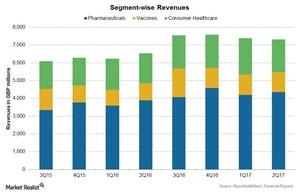

GSK reported operational growth of 3% in its revenues to ~7.3 billion pounds for 2Q17. This growth was driven by an increase in revenues across all three segments.

Segment-wise performance

Revenues for GSK’s Pharmaceuticals segment displayed a shift in product performance, reporting 3% growth in operating revenues during 2Q17. This growth was mostly driven by the strong performance of new products such as Triumeq, Tivicay, and Relvar/Breo Ellipta and partially offset by the impact of recent divestitures.

During 2Q17, GSK’s Pharmaceuticals revenues rose ~12% to ~4.4 billion pounds compared to 2Q16. We’ll discuss the details of the segment’s products and therapeutic areas later in this series.

The Vaccines segment’s operating revenues rose 5% during 2Q17, mostly driven by the strong performance of its meningitis and established vaccines. The revenues for the Vaccines segment rose ~16% to ~1.1 billion pounds in 2Q17 compared to 2Q16.

The Consumer Healthcare segment reported flat operating revenues during 2Q17. The reported revenues increased ~10% to ~1.9 billion pounds in 2Q17 compared to 2Q16. The increase was primarily due to the strong performance of the company’s pain relief and oral health products.

For broad-based exposure to this industry, investors can consider ETFs like the VanEck Vectors Pharmaceutical ETF (PPH), which holds 4.6% of its total assets in GlaxoSmithKline. PPH also holds 8.4% of its total assets in Johnson & Johnson (JNJ), 4.1% in AstraZeneca (AZN), and 5.1% in Pfizer (PFE).