Eli Lilly in 2Q17: Humulin and Endocrine Products

Eli Lilly’’s (LLY) Human Pharmaceuticals segment reported a rise of ~11.0% to ~$5.0 billion for 2Q17 compared to ~$4.6 billion for 2Q16.

July 31 2017, Updated 7:40 a.m. ET

Human Pharmaceuticals

Eli Lilly and Company’s (LLY) Human Pharmaceuticals segment reported a rise of ~11.0% to ~$5.0 billion for 2Q17 compared to ~$4.6 billion for 2Q16. The segment deals with therapeutic areas such as endocrine, neuroscience, oncology, and cardiovascular.

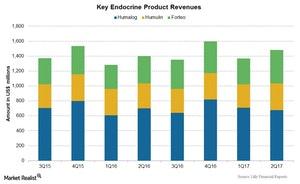

Some of the drugs in its endocrine franchise are Humalog, Humulin, and Forteo. Humulin and Forteo reported growth in 2Q17 revenues, while Humalog reported lower sales.

Humulin

The Humulin portfolio includes concentrated insulin products used to lower blood sugar levels in patients with Type 1 and Type 2 diabetes mellitus, generally in patients with higher insulin requirements. Sales of Humulin rose 8.0% to $357.8 million in 2Q17 compared to ~$332.3 million in 2Q16. That includes a rise of 11.0% in US sales and a rise of 3.0% in international sales.

Other endocrine products

The endocrine franchise includes Humalog and Forteo, which contribute more than 35.0% to Eli Lilly’s total revenues.

Humalog

Humalog includes various mealtime insulin products used to lower blood sugar levels in patients with diabetes. Sales for Humalog products fell 3.0% to $678.4 million in 2Q17 compared to $701.9 million in 2Q16.

Forteo

Forteo is used in the treatment of osteoporosis. Forteo sales rose ~22.0% to $446.7 million in 2Q17 compared to $367.6 million in 2Q16. That includes a rise of ~34.0% in US sales to $249.8 million and a 9.0% rise in international sales to $196.9 million.

To divest the company-specific risks, you can consider the PowerShares Dynamic Pharmaceuticals ETF (PJP), which holds 3.9% of its total assets in Eli Lilly. PJP also holds 5.1% in Celgene (CELG), 4.9% in Pfizer (PFE), and 4.8% in Gilead Sciences (GILD).