China’s Iron Ore Imports Surged in June—Where Will They Go Next?

It’s important for investors to keep track of China’s iron ore import data because they provide a clue regarding the demand patterns for imported iron ore among Chinese mills and traders.

July 24 2017, Updated 10:38 a.m. ET

Customs data and China’s iron ore imports

It’s important for investors to keep track of China’s iron ore import data because they provide a clue regarding the demand patterns for imported iron ore among Chinese mills and traders.

China is one of the world’s largest consumers of seaborne iron ore, consuming two-thirds of all seaborne iron ore.

China’s imports to top 1 billion tons

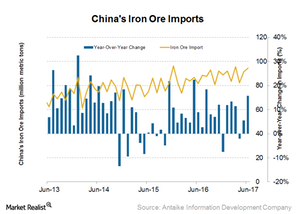

China’s iron ore imports have been very resilient in 2017. In June, its import volumes for iron ore reached 94.4 million tons, a rise of 15% compared to the previous year. This rise was in line with rising iron ore shipments from ports in Australia and Brazil. According to the latest data, imports in the first six months of the year reached 539 million tons, a rise of 9.3% year-over-year (or YoY).

China imported 1.0 billion tons of iron ore in 2016. Year-to-date, its imports are 9% higher than that figure. At this pace, China will easily surpass 1 billion tons of imports in 2017.

Crackdown benefits imports

As Chinese authorities have cracked down on plants causing pollution by producing steel from inferior ore, imports have surged. Investors should note that the majority of domestic Chinese iron ore is of very low iron ore content, which leads to pollution during the steelmaking process.

Iron ore from Australia and Brazil, which is mainly produced by miners (PICK) such as BHP Billiton (BHP), Vale (VALE), Rio Tinto (RIO), and Cliffs Natural Resources (CLF), is of higher quality and has fewer impurities. Ore from these destinations is also very cost-efficient compared to domestic ore, resulting in the replacement of domestic ore.