Scotts Miracle-Gro: Gross Margins Are Expected to Expand in 3Q17

Wall Street analysts expect gross income of $396 million in 3Q17, which will deliver a gross margin of 37% on 3Q17 sales estimates of $1.06 billion.

July 28 2017, Updated 4:35 p.m. ET

Gross margins

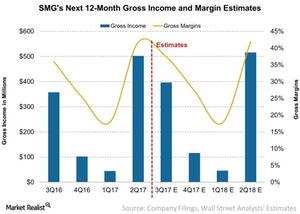

Earlier in this series, we saw that analysts expect sales growth of ~4.4% for Scotts Miracle-Gro (SMG) in the next four quarters. With the expectation for sales growth, the gross margins are expected to improve slightly.

Analysts’ estimates

Wall Street analysts expect gross income of $396 million in 3Q17, which will deliver a gross margin of 37% on 3Q17 sales estimates of $1.06 billion. The gross margins are expected to improve slightly from 36% in 3Q16. For the next four quarters, the gross margins are expected to expand to 36.1% from 35.3% in the recent four quarters.

Over the next four quarters, the gross income is expected to rise 6.7%, while sales are expected to rise 4.4%. Most of the margin expansion appears to be coming from expectations of cost optimization in the next four quarters.

Scotts Miracle-Gro sells many brands that earn decent margins and overlap with products sold by peers (XMLV) Central Garden & Pet (CENT), Seaboard (SEB), and Spectrum Brands Holdings (SPB). Read The Scotts Miracle-Gro Company: What’s Its Secret? to learn more.

Next, we’ll discuss how the company’s operating margins are expected to perform.