Could Rising Consumer Sentiment Boost REITs Like AVB?

According to the University of Michigan, the consumer sentiment index for May 2017 gained 2.5% year-over-year, standing at 97.1%.

June 15 2017, Updated 9:06 a.m. ET

The Trump administration and the apartment industry

The policies undertaken by President Trump could be a determining factor in the performance of residential REITs in the next four years. Trump’s stance for employers and consumers to “Hire American, Buy American” could encourage steady job growth as well as a consistent increase in real estate values going forward.

Optimism could boost the apartment market

The current political atmosphere could affect residential REITs like AvalonBay Communities (AVB). Trump’s pro-American policies created optimism among his supporters. The improving job market and rising stock market have boosted consumer confidence in the economy.

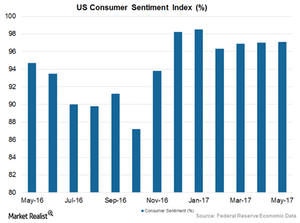

According to the University of Michigan, the consumer sentiment index for May 2017 gained 2.5% year-over-year, standing at 97.1%. This index reading was 0.1% higher than the 97% level recorded in April 2017.

With consumers’ higher purchasing power, apartment properties in high-demand cities experienced a steady price increase that began soon after the November 2016 presidential election.

Lower taxes trigger higher investment in housing

Another important aspect of Trump’s policies is the regulation of the tax structure. Some analysts believe that the Trump administration may loosen business regulations, enabling lenders to be more liberal in their underwriting standards.

Other apartment REITs such as Equity Residential (EQR), Essex Property Trust (ESS), UDR (UDR), and Camden Property Trust (CPT) also reported rent growth in high-demand cities after the 2016 election.

AvalonBay Communities (AVB) comprises 9% of the iShares Trust – iShares Residential Real Estate Capped ETF (REZ).

In the next article, we’ll focus on AVB’s strategic initiatives.