Has the ECB Been Successful in Taming the Euro?

The euro (FXE) closed the week at 1.1196 to the US dollar (UUP), posting a 0.76% loss compared to the previous week.

June 13 2017, Updated 7:37 a.m. ET

ECB is inching toward stimulus exit

The euro (FXE) closed the week at 1.1196 to the US dollar (UUP), posting a 0.76% loss compared to the previous week. The ECB (European Central Bank) policy meeting turned out to be a non-event with no surprises. The ECB confirmed that there would not be any future rate cuts and removed the easing bias. It failed to signal any tapering of its stimulus program, but that doesn’t change the view of the tapering to begin early next year. The takeaway from this month’s meeting is that the ECB is not yet ready to commit to removing the stimulus and is preferring to hold on to the stimulus insurance. ECB chair Mario Draghi will have to begin the process of tapering and will be preparing the markets for an eventual lift-off.

European equity indexes (VGK) posted marginal losses last week, despite the negative surprise from the UK elections. The German DAX (DAX-INDEX) closed at 12,816, posting a loss of 0.06% last week, and the SPDR Euro Stoxx 50 ETF (FEZ) posted a weekly loss of 0.24%.

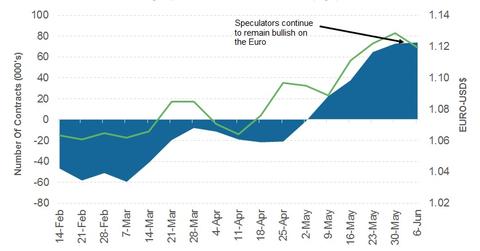

Speculative positions on euro continue to rise

Economic data from the Eurozone continue to improve with notable upticks in Europe’s GDP and Germany’s industrial production. According to the Commitment of Traders report published on Friday, June 9, 2017, traders have increased their speculative positions and continue to remain net long on the European currency. The total speculative positions increased to 74,009 contracts compared to 72,900 contracts in the previous week.

Key economic data and the Brexit to drive the euro

The final inflation numbers for May and the German ZEW investor confidence could be key data releases this week. Political challenges continue to remain despite British Prime Minister Theresa May’s managing to secure the support of the DUP (Democratic Unionist Party). It’s unclear if the Brexit negotiations, which are scheduled to begin this month, will lead to a hard or soft Brexit. Overall, the euro is likely to remain a positive play for the week ahead.

In the next part of this series, we’ll see how the British pound has reacted to the UK elections.