Barrick Gold’s and Other Miners’ Correlation with Gold

Metal stocks As we study the impact of global variables on precious metals and the mining sector, we should also analyze the relationship between mining stocks and gold. Correlational analysis can help us compare price movement in mining stocks and the metal. In this part of our series, we’ll examine New Gold’s (NGD), Newmont’s (NEM), Coeur […]

June 12 2017, Published 4:09 p.m. ET

Metal stocks

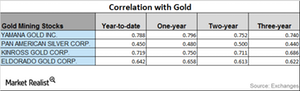

As we study the impact of global variables on precious metals and the mining sector, we should also analyze the relationship between mining stocks and gold. Correlational analysis can help us compare price movement in mining stocks and the metal. In this part of our series, we’ll examine New Gold’s (NGD), Newmont’s (NEM), Coeur Mining’s (CDE), and Barrick Gold’s (ABX) correlation with gold.

Funds such as the VanEck Vectors Junior Gold Miners ETF (GDXJ) and the Global X Silver Miners ETF (SIL) also have a correlation with gold. These two funds saw a drop in their price of 1.8% and 0.55%, respectively, on Thursday, as precious metals tumbled.

Correlation trends

Among the four aforementioned miners, New Gold has the highest correlation with gold, while Barrick has the lowest correlation. Over the past three years, all four mining stocks above, except Coeur Mining, have seen a rising correlation with gold.

An increase in correlation means it’s more likely a stock will follow precious metals. An increase in gold could boost miners, and vice versa.

Barrick has a three-year correlation of ~0.59 with gold and a one-year correlation of ~0.65. Its correlation of ~0.65 means that Barrick has moved in the same direction as gold ~65% of the time over the past year. It’s also important for investors to remember that correlation can move in different directions at different times.