Analysts’ View on International Flavors & Fragrances

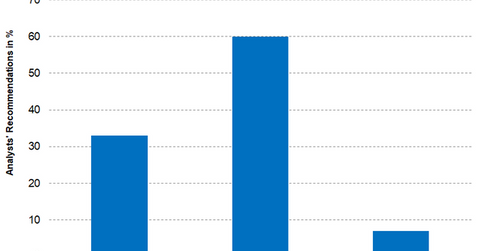

For International Flavors & Fragrances, 33% of the analysts recommended a “buy,” 60% recommended a “hold,” and 7% recommended a “sell.”

June 20 2017, Updated 7:36 a.m. ET

Analysts’ recommendations

As many as 15 brokerage firms are actively tracking International Flavors & Fragrances (IFF) stock as of June 14, 2017. Among them, 33% of the analysts recommended the stock as a “buy,” 60% of the analysts recommended the stock as a “hold,” and 7% of the analysts recommended the stock as a “sell.”

Analysts project a 12-month target price of $136.62 for International Flavors & Fragrances. The target price implies a return potential of 0.1% from its closing price of $136.51 as of June 14, 2017.

Most analysts recommended a hold

International Flavors & Fragrances posted better-than-expected 1Q17 earnings but fell short on revenue. However, the company expects its revenue to rise 7.5%–8.5% in fiscal 2017. International Flavors & Fragrances aims to increase its revenue by $500 million–$1 billion by 2020 through acquisitions. As a result, International Flavors & Fragrances has been aggressive in its acquisition strategy. It acquired David Michael, Fragrance Resources, and PowderPure. With its growth looking intact, many analysts recommend a “hold” on the stock.

Target prices by individual brokerage firms

Below are the recommended target prices by some well-known brokerage firms for International Flavors & Fragrances:

- Berenberg recommended a target price of $155, which implies a 12-month potential return of 13.5% compared to the closing price of $136.51 as of June 14, 2017.

- UBS (UBS) rated International Flavors & Fragrances as a “buy” with a target price of $138, which implies a 12-month return of 1.1% over the closing price of $136.51 as of June 14, 2017.

- Barclays (BCS) appeared to have a conservative view. It rated International Flavors & Fragrances as “underweight” with a target price of $112, which implies a 12-month potential return of -18% based on the closing price of $136.51 as of June 14, 2017.

Investors can indirectly hold International Flavors & Fragrances by investing in the PowerShares DWA Basic Materials Momentum Portfolio ETF (PYZ), which invested 2.3% of its holdings in the company. The fund’s top holdings include Chemours (CC) and FMC (FMC) with weights of 5.7% and 5.3%, respectively, as of June 14, 2017.