What Happened to Novartis’s Valuation after 1Q17?

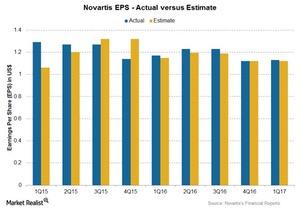

Novartis reported EPS of $1.13 on revenues of $11.54 billion for 1Q17, which represents 2% YoY operational growth in revenues.

June 1 2017, Updated 7:38 a.m. ET

Novartis in perspective

Headquartered in Basel, Switzerland, Novartis (NVS) is a pharmaceutical company specializing in the research, development, manufacturing, and marketing of a broad range of healthcare products. Novartis reported EPS (earnings per share) of $1.13 on revenues of $11.54 billion for 1Q17, which represents 2% YoY (year-over-year) operational growth in revenues.

NVS’s forward PE multiple

PE multiples represent what one share can buy for an equity investor. On May 30, 2017, Novartis was trading at a forward PE multiple of ~16.5x, as compared to the industry’s forward PE multiple of ~16.3x.

Specifically, competitors AstraZeneca (AZN), Pfizer (PFE), and GlaxoSmithKline (GSK) have forward PE multiples of 17.8x, 12.2x, and 15.4x, respectively.

The EV-to-EBITDA multiple

On a capital structure neutral basis, Novartis currently trades at ~15.4x, which is much higher than the industry’s average of ~10.5x. By comparison, competitors AstraZeneca (AZN), Pfizer (PFE), and GlaxoSmithKline (GSK) have forward EV-to-EBITDA multiples of 13.7x, 9.9x, and 9.4x, respectively.

Novartis’s analysts’ recommendations

Novartis’s stock price has risen nearly 0.6% during the past 12 months, while the analysts estimate the stock has a potential to return ~6.5% over the next 12 months. Wall Street analysts’ recommendations show a 12-month target price of $85.75 per share for NVS stock, as compared to its price of $80.53 per share on May 30.

Meanwhile, 50% of analysts have recommended a “buy” for NVS stock, while 50% analysts have recommended a “hold.” The consensus rating for Novartis stands at 2.00, which represents a moderate “buy” for long-term growth investors.

To divest risk, investors can consider ETFs like the First Trust Value Line Dividend (FVD), which has 0.6% of its total portfolio in Novartis.