Understanding Priceline’s Business Model

Priceline has mostly followed the agency model, where hotels and other service providers list their own offers and pay Priceline a commission for every transaction.

Nov. 19 2015, Updated 12:04 p.m. ET

Overview

Priceline Group (PCLN) is the global leader in online travel services, the companies that provide hotel bookings, car rentals, and flight reservations in the OTA (or online travel agency) market. This is mostly due to its pioneering agency business model and high profit margins compared to other peers in the OTA industry.

How does Priceline work?

Priceline Group’s prime customers are either business travelers looking for travel arrangements and accommodations, or leisure travelers looking for holiday products and deals. The company aids these users in their travel search and helps them gain access to booking availability and details of airlines, hotels, cruises, and car rental packages on a single platform.

Bookings are made by users under the traditional price-disclosed model or via the opaque pricing model. In the traditional price-disclosed model, the company earns a commission on every transaction made on its website. In the opaque pricing model, Priceline earns the difference between the price a customer is willing to pay—expressed by bidding—and the price charged by the travel service provider. The company was the first to introduce the “name-your-price” model for making online bookings.

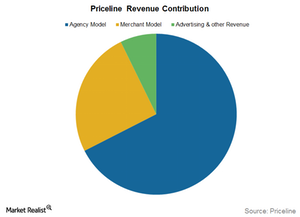

Apart from the traditional revenue streams, Priceline also sells space for suppliers of travel products and services to advertise their websites, which also leads to robust revenues for the company.

Agency model works for Priceline

Priceline Group (PCLN) has mostly followed the agency model, where hotels and other service providers list their own offers and pay Priceline a commission for every transaction. This is a more profitable business model, as it requires a lower level of investment and lower costs for the company.

Priceline competes with major online travel companies like Expedia (EXPE), Ctrip (CTRP), Travelzoo (TZOO), MakeMyTrip (MMYT), and TripAdvisor (TRIP). Priceline accounts for 3% of the Top Guru Holdings Index ETF (GURU).

In the next part, we’ll look at the revenue contributors for Priceline.